Synthetix Quarterly Report — Q2 2022

Quarterly Report for Synthetix, Quarter 2 of 2022: April — June.

Let’s start with the highlights, shall we?

Q2 Highlights

⭐ Spartan Council/CCs: Upgraded Liquidation Mechanism & Atomic Swap Integrations

⭐ Grants Council: Dune Analytics Grants & Wrapper UI (ongoing)

⭐ Ambassador Council: Spartan Spaces & Ambassador Mandate

Wow…what a roller coaster this epoch has been. In all the adversity and firefighting that we’ve seen over the past few months, Q2 was still full of highlights and milestones that continue to set Synthetix apart from the rest. Let’s take a moment to review the best of Q222.😉

The Upgraded Liquidation Mechanism, which had been in the works for quite a while, was finally deployed in May! This helped Synthetix weather the macro storm that began raging shortly after the collapse of UST. Previously, anyone who was able to identify an eligible staking account could liquidate the account and collect the liquidation penalty. The new mechanism enabled socializing the effects of liquidations, thereby keeping the debt in-house and rewarding those who are the most bullish on the future of Synthetix — STAKERS!

And even in all the chaos, if there was ever a time to be bullish, there are plenty of signs that it may be now. The 1inch atomic swap integration is likely the highlight of highlights this epoch. 1inch routed over 2x the volume of the entire first quarter through Synthetix in the last 3 months alone coming in at just over $2 billion for Q2. With some additional integrations on the horizon, we hope to see many more protocols taking advantage of the new update to the Atomic Swap functionality in the coming epoch!

The Grants Council stayed busy this epoch doing what they do best — filling the gaps by funding value-add projects outside the scope of Core Contributor (CC) duties. One of these projects was a stunning Dune dashboard providing insights into the recently launched futures markets that aren’t available elsewhere. The team is constantly looking for ways to leverage Dune Analytics and grant funding to bring the community data they need to make informed investment decisions and funded several analytics projects over the course of the epoch. They also got the ball rolling on several other initiatives that will extend into this next epoch, including the coding and design of a Wrapper UI and the NFT project. Also noteworthy, in collaboration with the Ambassadors, the Grants council helped fund the technical work needed to push through a Uniswap proposal that will benefit the ecosystem.

And speaking of Ambassadors, the Ambassador Council also had a very busy epoch. The ‘Spartan City Hall’ initiative has been rebranded as ‘Spartan Space’ and many of them were hosted on Twitter to expand the reach of these discussions with other protocols. They hosted a total of nine Spartan Spaces and one L222 call this quarter. The consistency of these events really started to pick up this epoch, and a huge part of that was the self-imposed KPI mandate that Millie proposed that was codified in governance via SIP-224.

Challenges

It’s hard to describe the challenges that Synthetix has faced this epoch without first addressing some of the macro/systemic risk challenges that the industry has faced over the last several months. Much of this can be traced back to the collapse of UST and the fallout from one of the largest stablecoins in DeFi vanishing overnight. It’s also difficult to ignore the global macro environment in this assessment. As financial conditions continue to tighten and liquidity dries up in markets across the globe, the Synthetix team has had to remain incredibly agile in order to respond to several high priority events.

Although there has been some relief recently, SNX experienced some very heavy price pressure this epoch. Getting down to prices not seen since DeFi summer, some vulnerabilities were identified, and patched, under this extreme load. The c-ratio was lowered to 300% temporarily to relieve some of that stress, while the CCs put out fire after fire for nearly a month. And while we were all excited to finally hear about the planning and work already being done on V3, some of these firefighting efforts required all-hands-on-deck. So, some V3 resources were tapped to help maintain V2X — which may result in V3 delays.

Inflation was another hot topic this epoch with several different views on how to address the inflationary rewards mechanism laid out in the target staking ratio SIP. While the data seemed promising at the end of the previous epoch, it became clear over the last 2 months that the staking ratio had reached a plateau. Unfortunately, this came at a time when the protocol was under a lot of pressure and there were concerns that changing the incentive structure might disturb the staking equilibrium and place additional stress on the protocol. A similar argument was made against the modification of the c-ratio from the emergency level of 300% to 350%. Synthetix’s risk partner, Gauntlet, attended one of the public Spartan Council meetings to share the results of their risk modeling and the governance decision they came to was to raise the c-ratio.

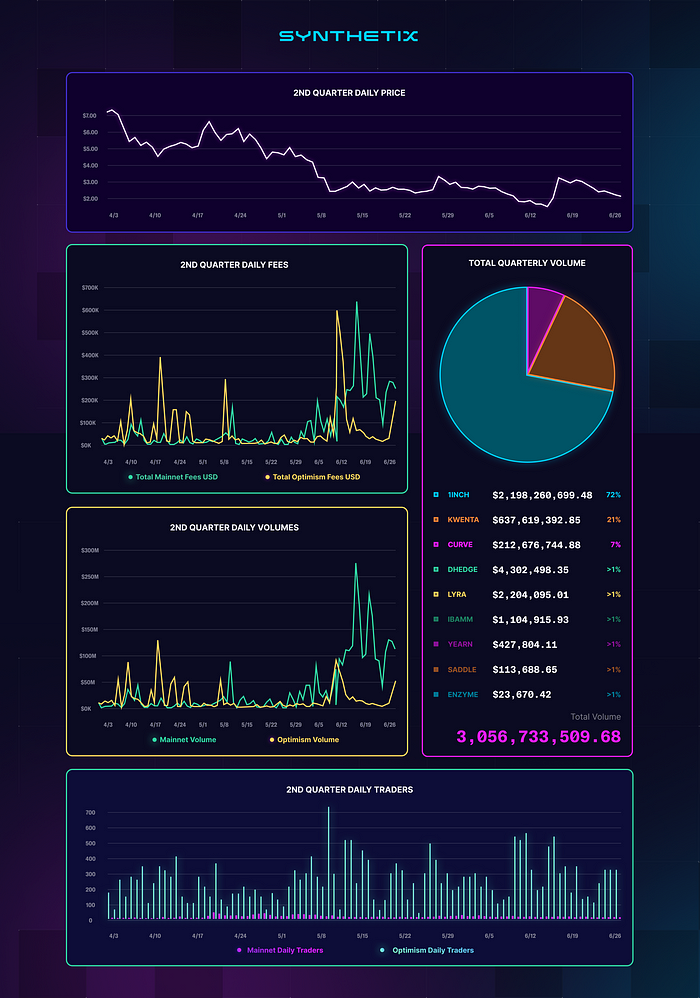

Protocol Stats

Overview of Synthetix Q2 Stats: April 2022 — June 2022.

Meet this Epoch’s New Core Contributors (CCs)

Jade

- Joined: May 2022

- “Hi all, I’m Jade ☀️ I worked as a contractor for Synthetix for three months before joining as a full-time CC in May 2022. I’m quite a newbie to Web3 and DeFi but I’m always eager to learn! I work both as a graphic designer (anything such as social media graphics, animations, illustrations, presentations and so on) and as a UX/UI designer (creating and strengthening user-centric apps). Working closely with Darda and Steve.”

Sunny

- Joined: May 2022

- “Hello all! I’m Sunny. I joined a few weeks back as a full stack engineer primarily working on v3. I bring over a decade of software development experience, recently working at the crypto exchange Gemini, where I worked as a Staff frontend engineer helping build out dope UI’s and managing some backend services. I’ve architected many front end applications from the ground up and helped launch a few startups along the way. I’m a new entrant into the web3 space, started learning Solidity late last year. Excited to learn from the great team here, help launch v3, and contribute across the stack. Nice to meet you all.”

James (JZ)

- Joined: June 2022

- “Hi All, my name is James and I started with Synthetix today. I’ve been working as an engineer for the last 7–8 years with a focus on frontend apps (react/react native). Got crypto-pilled early last year and did some research at my former company, but will now be full time working on front-end stuff with Synthetix.”

Steve

- Joined: June 2022

- Steve worked with Synthetix as a contractor prior to being hired as a Core Contributor this past June. Before that, he was a product designer for an agency in New York, primarily working on fintech products for clients.

Nikita

- Joined: June 2022

- “Hi! My name is Nikita and it’s my first week as CC at Synthetix. I have been a full stack web2 engineer for the last 20 years. Been doing some web3 development on a side (dapp with Algorand) for the past year or so too. My main focus would be frontend / ops at this point: developer experience improvements, builds, bundle optimizations, package management, mostly with the Staking web. Super stoked to be on board.”

David

- Joined: June 2022

- “Hi everyone, I’m David👋. I joined Synthetix yesterday as a Solidity Engineer and I’ll be working together with Arthur on our futures contracts. I’ve been a SW Engineer in web2 for close to a decade. I’m mostly a generalist but lean more on backend, architecture, and DevOps. Worked in a handful of startups, SMEs, enterprises, and ran my own consultancy business for a few years. Industries were diverse but mostly focused on AI in healthcare, security, and more recently fintech. A few months ago, web2 didn’t make sense for me anymore and like many others, deep dived into defi and decided this was my end game so to speak. I reached out to a few connections and here I am. Glad to be part of the team.”

Spartan Council

Q2 2022 Spartan Councilors: Afif, calavera, Danijel, JVK, Kain, ksett, Mark, SynthaMan

Along with their contribution to the achievement of major Synthetix milestones this epoch, let’s take a minute to review everything else the Spartan Council was able to achieve in just the last 3 months.

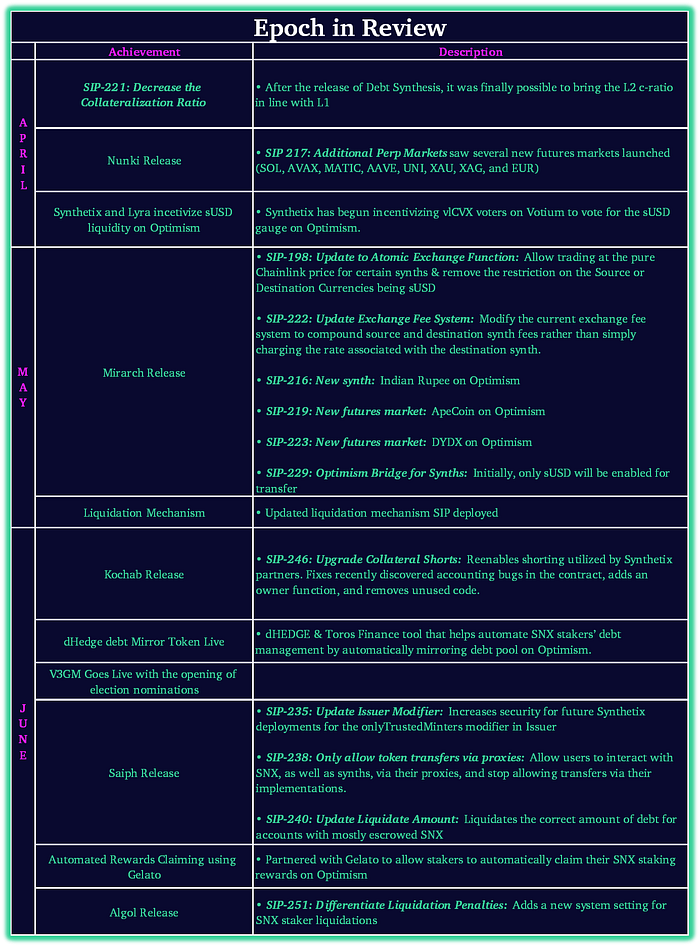

April was a busy month for the Spartan Council as they continued the momentum from the previous epoch by putting to work all of the products and features that had just been launched. Following the release of debt synthesis, it was finally possible for the Optimism c-ratio to match that of Mainnet, and they immediately lowered it to 400%.

We also saw perps markets added for all the new synths that launched at the end of Q1 following futures. These went out on the Nunki release which also added gold and silver perps in the first commodity synth launch on Optimism. To round out the month, Synthetix and Lyra partnered to incentivize sUSD liquidity on Optimism.

May began with a huge release — Mirarch. Six SIPs went out on this release, covering a range of achievements for the protocol. First, we got to see just how flexible governance could be in adding synths following the futures launch. Previously, listing new synths required an extensive risk assessment and feasibility process. Part of the beauty in the design of futures is the risk parameter configurability that allows for safe testing in live markets and easy adjustment based on real data.

In addition to the release of the Indian Rupee Synth, ApeCoin perp and dYdX perp markets, Mirarch also included an update to the exchange fee system, the introduction of an sUSD bridge between mainnet and Optimism, and an update to the atomic swap functionality. The fee system update sought to bring down fees on stablecoin pairs while maintaining the same front running resistance of the current fee structure. The logic for this improvement was that when pairing volatile assets for exchange, the exchange price relies on two separate, possibly volatile, feeds compared to stablecoin swaps where one asset in the pair is stable.

The sUSD bridge says it all in the name. For the first time, sUSD will be able to move freely between networks with the one caveat that this transfer was happening over the Optimism bridge and required a 7-day delay in transfers from L2 to L1. Even though this SIP was implemented, transfers are currently paused. We will still have to wait for Chainlink’s Cross Chain Interoperability Protocol (CCIP) to see the full benefit on synth transfers between networks unlocked, but the Optimism bridge addition will solve a major problem — the ability for large quantities of sUSD to move from L1 to L2 without having to burn/mint.

The update to the atomic exchange function also went out on this release. Kaleb first introduced this SIP late last year, but the release of futures took priority for much of the first quarter. After some delays, it eventually went out on Mirarch. Coincidentally, 1inch integrated atomic swaps around this time as well and eclipsed every other integrator this quarter accounting for 72% of the total volume routed through Synthetix. And where there is volume, there are fees! In fact, late in Q2 marked the first time the protocol earned enough in fees to sustain itself.

Shortly after the Mirarch release went out, the upgraded liquidation mechanism was finally deployed. This was another one that had been on the list for a while but just could not find priority ahead of some of the other more exciting product releases and upgrades. This upgrade mitigated damage for the protocol during periods of stress and reduced the likelihood of a cascading liquidation event.

A total of four SIPs were implemented in June over the course of two releases. At the beginning of the month, the Saiph release went out and included SIPs to update the issuer modifier, allow token transfers via proxies, and update the liquidations contract. These SIPs resolved issues that had been identified over the course of several weeks in May.

We also saw the V3GM election module finally ship just in time to be functional for this epoch. The use of this new contract marks the first time Synthetix governance votes have been cast and counted on chain. In another first for Synthetix, rewards claiming was automated at the end of the month via a new partnership with Gelato. Though Synthetix staking has not followed the “set-and-forget” model that is common in DeFi, the ability to automatically claim rewards does feel like it’s one step closer.

In terms of governance decisions, the Council closed out the epoch addressing a minor liquidation penalty issue. It became clear that collateral loans and staking positions were two very different protocol interactions, but there was only a single liquidation variable assigned in the contract. SIP-251, which went out on the final release of the epoch (Algol), addressed this issue by adding a variable to distinguish between the two.

Grants Council

Q2 2022 Grants Councilors: ALEXANDER, BigPenny, CT, cyberduck, Mike

The Grants Council had another successful epoch of identifying opportunities, managing grants, and leading initiatives to contribute to the growth of the Synthetix ecosystem. Here are this epoch’s highlights from them:

- DevSpace Hackathon sponsor

Way back when, the Grants Council registered Synthetix as a sponsor for the DevSpace Hackathon in India, and the event happened this past April. DevSpace is a global, student-run hackathon and conference that aims to provide solutions to real-world problems. During the event, Core Contributor Noah represented the protocol as the keynote speaker. He worked with the Grants Council to put together a great set of slides about Synthetix, and delivered a thoughtful presentation that was posted on YouTube.

The Council also offered up a discretionary prize to any team that built something that could potentially integrate with Synthetix, however nothing was awarded in the end due to the criteria not being met.

- Revoke.cash on Optimism

Did you ever want to revoke your token allowances on Optimism but couldn’t? Well the Grants team helped make that possible this epoch! Revoke.cash is now multichain, and Synthetix Grants provided the bounty to help get it on Optimism. Revoke has always supported Ethereum, and has tried to support other EVM chains in the past, but since most EVM chains lack the public infrastructure that Revoke requires, they previously weren’t able to support more chains. So in order to expand their chain support, they used Covalent, which allowed them to add the following networks:

-Binance

-Avalanche

-Polygon

-Arbitrum

-RSK

-Fantom

-Harmony

And specifically with the help from the Grants Council in April, they were also able to add Optimism to their list of supported networks. Since then, they have added even more networks:

- Tip.cc manual conversion service

Did you use this?? Back in May, the Grants Council offered to manually tip opSNX in exchange for any SNX that was tipped to them in Discord. Inspired by Thales, they took the initiative to get SNX on Optimism supported by tip.cc, AKA tipbot. In doing so, Optimism SNX became supported as “opSNX” and included deposits and withdrawals to and from Optimism. The Council then offered this manual conversion service to help users get around those pesky Mainnet withdrawal fees that come with SNX tips. Pretty handy!

- Telegram Bot update

Wow, another useful tool from the Grants Council? What can’t they do? This update to their already convenient Telegram Bot made it even more helpful. Thanks to them, the bot now includes a Liquidation Flag. So we hope you’re managing you’re c-ratio!

- Attendance & Participation Report

Ever wonder which of your elected Council members are actually putting in the work? Well thanks to your friends at SNXweave and the Grants team, now you know! Synthetix strives for as much transparency as possible, so this report was another great step in that direction. By providing data on attendance records, voting patterns, and peer-to-peer feedback, this report hopefully provided some useful information for voting. And since it was the first of its kind, the Grants Council welcomes any feedback to help improve it for next time.

- SNXweave weekly

Last but not least😉 Our team has closed off another great epoch of working closely with the Grants Council to bring you the weekly news in both blog and podcast form. This epoch, SNXweave published 13 Weekly Recap blog posts & 13 Weekly Recap podcasts. We also had the pleasure of hosting and recording another LIVE Spartan Council Election Panel, and there was quite an interesting development in the votes towards the end of the call! People were listening! And to further make our content accessible, we added a YouTube channel this quarter. So now you can hear Connor’s soothing voice in even more places. #wenconnorASMR

And now, we’re finishing Q2 off strong with Synthetix’s second-ever Quarterly Report.

*respectful bow*

What’s next for the Grants Council?

Well, I’m glad you asked. We actually have some leaky leaks for you!

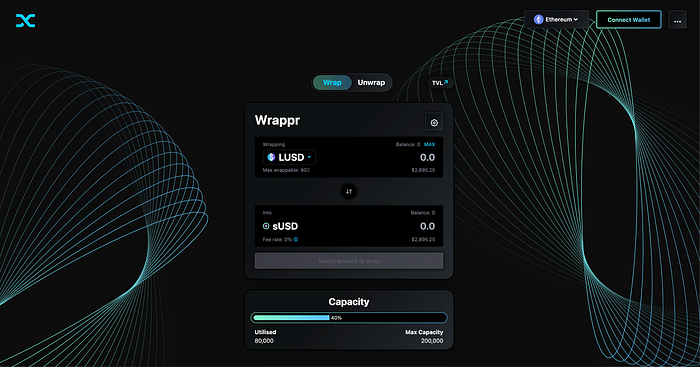

-Wrappr UI

- This project has been in the works since the beginning of the epoch, shortly after it was first suggested during the March gov call, and the Grants Council immediately began brainstorming how they could bring this tool to the community. Since then, they have had 2 devs working hard on 2 different designs. Here is a sneak peek at one of the designs for the Wrappr UI:

-NFT project

- The Grants Council has also been hard at work this epoch ironing out all aspects of the NFT project: designs, mint contract, lore, working with Quixotic to coordinate trading, and more. We are SO excited to give you another design leak from them, and even MORE excited for these NFTs to finally drop…just LOOK at them!

Ambassador Council

Q2 2022 Ambassador Councilors: mastermojo, Matt, MiLLiE

If you ask ANYONE in the Synthetix community, they’ll tell you that the Ambassadors have been on fire this epoch. Ever since the implementation of the recently proposed key performance indicator (KPI) Ambassador mandate, the Council has been reaching new heights of protocol outreach and growth. We’ve broken the epoch down by KPI, so let’s briefly review each of them:

✅ Spartan Spaces/ L222s

1. Spartan Space — Thales & UMA (30 listeners, Length: 1.5 hours)

- Guests: Danijel from Thales & John from Risk Labs (which works on UMA)

- Thales started as a binary options spin-off from Synthetix, and UMA is an optimistic oracle service that provides data for smart contracts.

- Recording here

2. L222 Tuesday — Polynomial & Lyra & Kain (150+ listeners*, Length: 1 hour)

- Guests: Kain (founder of Synthetix), Mike (co-founder of Lyra), and Gautham (founder of Polynomial)

- Recording here

3. Spartan Space — EthernautDAO (45 listeners, Length: 1 hour)

- Guests: Ale and Dhannte

- EthernautDAO is a public good DAO aimed at transforming ordinary developers into Ethereum developers. Essentially, grabbing senior devs from web2 and giving them a web3 crash course.

- Recording here

4. Spartan Space — DeFi Grants (33 listeners, Length: 1 hour)

- Guests: Mike from Synthetix, Cody from Lyra, Matt from dYdX, and Max from Perpetual protocol

- Recording here

5. Spartan Space — Stargate (56+ listeners, Length: 1 hour)

- Guests: Brian, who is one of the co-founders of LayerZero Labs, and helped build Layer Zero and Stargate.

- Stargate is a fully composable liquidity transport protocol where you can transfer native assets cross-chain while accessing the protocol’s unified liquidity pools with instant guaranteed finality.

- Recording here

6. Spartan Space — Popcorn Finance (33 listeners, Length: 45 minutes)

- Guests: Leon, who is the lead dev at Popcorn and has been on the team since the very beginning, and Anthony, who is the founder of Popcorn and wrote the whitepaper.

- Popcorn is a new paradigm for decentralized finance where yield-generating products simultaneously contribute to social impact.

- Recording here

7. Spartan Space — Quixotic (65 listeners, Length: 1 hour)

- Guests: Mark, who is a developer and focuses on the smart contract side of development, and Daniel, who was previously a product manager for YouTube and Google, and focuses on the frontend side.

- Quixotic is the largest NFT marketplace on Optimism.

- Recording rugged — sorry!😓

8. Spartan Space — dHEDGE & Toros (34 listeners, Length: 1 hour)

- Guests: Jake, Matt, and Jakey. Jake is the head of growth and marketing, Matt is a community manager, and Jakey is a core contributor on the contracts team at dHEDGE.

- dHEDGE is an asset management platform that launched in August 2020 with very close ties to Synthetix. They currently have 1,300 funds on the platform, managed by 1,000 manager wallets.

- Toros is an incubated protocol that dHEDGE launched this past February. More specifically, it’s a protocol that’s structured for automated strategies, which ties in very nicely with dHEDGE’s funds service.

- Recording here

9. Spartan Space — Uniswap V3 (54 listeners, Length: 1 hour & 15 minutes)

- Guests: UniswapV3 experts David and Gill. David is a developer who has worked on several projects associated with Uniswap around incentivization. Gill is a professor at Cornell University, with a background in applied physics, and has been intrigued by UniswapV3 since its launch last year. Together, David and Gill have collaborated on a modification to the original UniswapV3 contract and have really in-depth knowledge of what it can do.

- UniswapV3 offers some notable improvements from V2, including: Easier to automate swapping, much more capital efficient, enables users to specify a certain range to their liquidity (because of this, liquidity can be concentrated more effectively, achieving up to 2000x the capital efficiency of V2)

- Recording here

10. Spartan Space — Euler (53 listeners, Length: 1 hour & 10 minutes)

- Guests: Michael, co-founder of Euler

- Euler is a permissionless lending protocol, custom-built to help users lend and borrow more Ethereum-based tokens.

- Recording here

✅ Proposals

1. SIP-224: KPI-based Ambassador Mandate (author Millie)

- Millie wrote this proposal to create a more structured approach to the Ambassador Council role based on a number of key performance indicators.

- Approved in April with 8 votes in favor

2. SCCP-187: Update Open Interest Limits — Increase sGOLD (sXAU) (authors: Matt, mastermojo, Millie)

- The Ambassadors proposed this SCCP to increase the sGOLD (sXAU) futures market MaxMarketValueUSD to sUSD 2.5 million from sUSD 1 million.

- Approved in April with 6 votes in favor

3. SCCP-189: Change SNX Inflationary Distribution Ratio (author: Matt)

- Matt proposed this SCCP to alter the SNX inflationary distribution ratio from 30% Optimism, 70% Ethereum Mainnet to 40% Optimism, 60% Ethereum Mainnet after a one week grace period from the date of this SCCP passing a Spartan Council vote.

- Approved in April with 6 votes in favor

4. Aave Request for Comment (ARC): Enable sUSD as collateral on AAVE V3 on Optimism (authors: Matt, Millie)

- There is significant liquidity for sUSD on both Mainnet and Optimism, so the Ambassadors proposed that it be enabled as collateral on AAVE V3 on Optimism.

5. SIP-242: OP Token Distribution (authors: Millie, Matt, Mojo, Afif, Bojan)

- This SIP proposed a distribution mechanism for OP tokens to be claimed from the Optimism Governance Fund.

- Approved in May with 6 votes in favor and 1 against

6. SIP-241: KPI-based Ambassador Mandate update (author: Millie)

- This SIP replaced SIP-224 with updated KPIs that more accurately reflected the Ambassadors goals.

- Approved in June with 8 votes in favor

7. Uniswap Proposal — Enable 1bp Fee Tier on Uniswap V3 Optimism (L2)

- Temperature check, Consensus check, Snapshot vote

- Passed in June with quorum, 12M UNI in support

✅ Governance Power

1. Gearbox token delegation

- 1.2M GEAR delegated to snxambassador.eth

2. OP token delegation

- 1,724,199 OP delegated from 1,947 delegators

3. Top 12 delegate for HOP protocol

- 488,366 delegated votes representing 2% of circulating supply

4. Euler delegation application submitted

✅ Referrals

1. Grants Council referral (April)

- CryptoTesters: Gabriel Haines referred for a grant to produce a video explainer series on Synthetix. Gabriel has a large following on Twitter and YouTube.

2. Treasury Council referral (May)

- Made introduction between Velodrome and the Treasury Council for launch partners (Treasury Council now has a veNFT representing 1% of VELO emissions, credits to Mojo)

3. Grants Council referral (June)

- The Ambassadors, along with the Grants Council, contacted protocol aggregators to integrate Atomic Swaps. They reached out to Dodo, MetaMask, Cowsap, 0x, Matcha, Zapper, and Zerion with developments in the works.

✅ Published Material

1. Synthetix Article on DefiLlama Wiki

- In April, Mastermojo posted this helpful article on DefiLlama’s new Wiki page, giving a brief overview of Synthetix and the ecosystem.

What’s next for the Ambassador Council?

The Ambassadors have several goals for the new epoch:

- Advocating for a new seat to better fill the large demand for inbound/outbound partnerships

- Develop a more formalized process for bringing new/existing projects through the flow of building on or with Synthetix

- Advocate for a “One-time integrations budget,” i.e. allow Ambassadors to fund one-off bounties for new/existing projects to integrate with or build on Synthetix

- Expand the reach of the Synthetix Ambassadors onto YouTube

- Create a new and improved Ambassador website on Notion (one-page website showing a breakdown of what ambassadors do, how to contribute to the Council, etc.)

Best Memes from Q2

The quarter of course wasn’t without humor, so here are our favorite memes from the epoch: