The Perps Play-Offs: Synthetix vs. GMX

Competition in DeFi is good. More competition means more efficient markets, innovation and increasingly optimized ecosystems for us to present to new users when the bull market rolls in. So this blog isn’t about pitting protocols against each other - no sir. It’s about examining distinguishing features of decentralized perps, particularly that of Synthetix and GMX, to showcase unique points of difference and why they matter. Of course this piece will be biased - I am a Synthetix Core Contributor after all. But what it should also be is an insightful, reasonably balanced analysis of two protocols leading the way in a very exciting space right now. So let's get into it!

An overview

Synthetix Perps:

Synthetix Perpetual Futures (Perps) are a novel perpetual future that launched in late 2022, and really started to make an impact on the space earlier this year. Live on Optimism, Daily Trading Volume for Synthetix Perps is currently at more than $200M with the help from frontend integrators Kwenta and Polynomial - who have this year both seen all time highs. Synthetix Perps today offers arguably the best capital efficiency for on-chain leverage across 50+ assets (forex, crypto, gold/silver), allowing traders to use up to 50x leverage on positions, while also supporting extremely competitive fees thanks to off-chain oracle provider Pyth Network.

So what are the key features of Synthetix Perps:

- Hybrid oracles that combine multiple sources, and use signed off-chain price updates to improve performance and reduce trading fees to 2/6bps for major pairs.

- A skew-dependent premium/discount function to incentivize rebalancing, and increase composability for assets with a wider range of liquidity profiles.

- A funding rate velocity mechanism to create natural price discovery and smooth out funding rate trajectories. More on this later.

Dynamic funding rates and price impact have led to largely neutral markets (no long or short skew) so Synthetix LPs aren’t dependent on trader performance, instead, sitting back and collecting fees.

GMX Perps:

GMX is broadly lauded for its deep liquidity and easy-to-use frontend. A decentralized spot and perps platform - GMX supports low swap fees and zero price impact trades, allowing users to leverage up to 50x on their trades. Impressive.

GMX is on Arbitrum and Avalanche, with trading supported via a multi-asset liquidity pool that generates rewards from market making, swap fees, leverage trading and asset rebalancing - which are for the most part fed back to Liquidity Providers (LPs). Markets include BTC (and WBTC), ETH, AVAX, LINK and UNI.

The protocol launched its V2 product in August 2023, hoping to overcome some drawbacks of the V1 product, particularly around risk management and fees. More on this later.

It’s a clean, user-friendly exchange that offers thorough data on trading, fees and liquidity. GMX also boasts a non-inflationary tokenomics model, so it doesn’t require inflationary token incentives.

So that’s the good stuff, and look - it is really good stuff. But we can’t be all praise here. Let’s talk about a few of the pitfalls for both the protocols’ Perps offerings, and then deep dive into some specific areas that should be interesting to users.

Pitfalls

Synthetix:

- Some might say UX hasn’t been at the absolute forefront of Synthetix’ strategy. The user journey, designed like 100 years ago in crypto-years, is mostly controlled by integrators and has been completely acceptable for the degens among us. But new users aren’t so comfortable with the long hike to Optimism, or the need to sign every action. Fair. In good news, Kain is working to solve these problems with his new frontend Inifinex, and shoutout to both Kwenta and Polynomial who are continuing to develop their UX in the meantime. What’s more, there’ll be further optimisations when Synthetix V3 Perps takes the stage later this year.

- Inflation. The community has played around with inflationary incentives a number of times over the years and while these changes have been successful in bootstrapping the network, inflation fundamentally tampers with incentives. As mentioned earlier, the GMX model doesn’t have this issue. Kain put forward a proposal to combat inflation 3:1 SNX split plus buyback as part of his previous role on the Synthetix TC. Watch this space.

GMX:

- Although GMX fees are good, they’re not as good as Synthetix fees. At the time of writing GMX boasts 10bps on all pairs, while as mentioned Synthetix offers 2/6bps for its major pairs. It goes without saying that it’s critical to be as competitive as possible in the decentralized perps space right now.

- Similar to how markets built on top of Synthetix operate, GMX V2 features funding fees as a way to support the reduction of large imbalances within pools. When there are too many open long positions, the funding fees will move to the short side, and vice-versa. Despite the intro of funding fees, borrowing fees will still exist to ensure that users avoid taking unnecessary positions. Borrowing fees are paid to LPs and help to prevent users from opening both long and short positions to take up pool capacity without paying any fees. The concern? This cost adds up over time and can liquidate positions, even during a flat market.

Now that icky part is over - let’s see what’s under the hood of each protocol regarding these specific Perps fundamentals - Liquidity, Fees/Price impact, Funding Rate and Oracles.

Liquidity

Liquidity is one of the biggest challenges for decentralized exchanges. Both Synthetix and GMX pride themselves on deep liquidity - but have very different frameworks.

Synthetix:

- SNX stakers provide the liquidity and are tasked to actively manage their debt on a weekly basis. In this sense - a lot is required of Synthetix LPs. If stakers were only backing perps, they'd be delta neutral, but because they're also backing spot/options/etc, they're responsible for more active management. As an option, lazier (or smarter?) LPs can swap their borrowed sUSD into dSNX, which hedges for them, as dSNX replicate the fluctuations of the debt pool.

- Importantly, 100% of fees go to these SNX stakers to reward their hard work.

GMX:

- A benefit of the GMX model is that GMX stakers do not need to actively manage their debt as Synthetix Stakers do.

- GMX V1 uses a separate token called GLP that is utilized for providing liquidity. GLP represents an index of many different assets that can be minted or redeemed based on the percentage of that asset in the pool. This framework means 70% of fees go to GLP stakers and 30% of fees go to GMX stakers.

- GMX V2 isolates liquidity across different assets in an AMM style manner. This allows for more assets to be permissionlessly listed, but liquidity providers now need to become more sophisticated in order to turn a profit, and eliminates the UX ease of purely holding GLP.

I’ll let the reader come to their own conclusions on the differences/benefits of these frameworks.

Fees / Price Impact

The issue of high gas fees is clearly important to both protocols’ agendas, with L2 scaling solutions in place for both - Synthetix on Optimism and GMX on Arbitrum. This move puts both Perps offerings in good stead to appeal to new users/mass adoption. A few other points of note:

Synthetix:

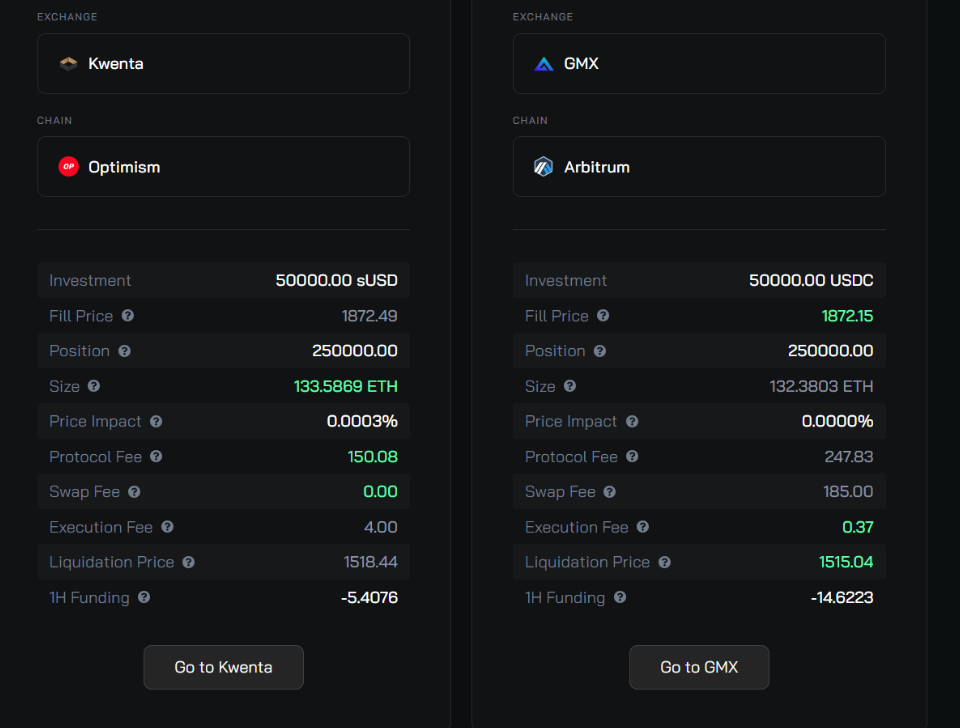

- Fees will typically always be lower using the Synthetix platform due to the protocol’s fee system. Unlike GMX, Synthetix only requires a perps fee, no swap fee. There may be a case, however, if a user makes a small trade, that SNX perps fees could be higher due to a higher execution (keeper) fee. This is a ramification of Synthetix’s decentralized, off-chain oracles. But for larger-size trades, users should always experience lower fees using Synthetix Perps.

GMX:

- GMX has updated their Execution Fee with V2 to help balance open interest and reduce risk to LPs. The Execution Fee in V2 has been lowered to 0.05%-0.07% at open and close. If a trade contributes to the side with more open interest, it pays 0.07%, and the underweighted side pays 0.05%.

- There is indeed a price impact in GMX V2 too. There could be a positive or negative price impact for increasing / decreasing positions and for swaps.

Funding Rate

We touched on the dynamic funding rate earlier, but here is some more detail to help readers understand the risk management impacts.

Synthetix:

- The dynamic funding rate, while sharing similarities with the traditional funding rate, has a few key differences. Instead of relying solely on market skew to determine the funding rate, the dynamic funding rate takes into account both velocity and market skew. This means that when there is a persistent long skew, funding rates will continue to increase over time. Conversely, when short positions dominate, funding rates will decrease as long as the short skew is maintained. By incorporating velocity into the funding rate calculation, this mechanism encourages traders to take positions opposite to the current market skew, promoting market stability and balance.

GMX:

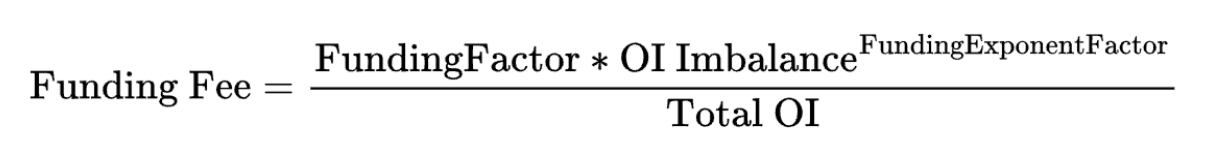

- GMX' new V2 Funding Fee improves on its original ‘Borrow Fee’ in V1, which meant all traders had to pay an interest rate as opposed to just one side of the trade. The V2 Funding Fee is paid by the overweight OI side of the trade, to the underweight side, and is based on the trade imbalance. For example, if there is more OI long than short, longs pay shorts. The funding fee paid by the dominant side is based on the following equation, and accompanies a borrow fee as well.

Oracles

When it comes to oracles, decentralization is paramount and influences much of Synthetix’ decision making. There will always be trade-offs when it comes to decentralization, but the user benefits of a permissionless, low-fee system aligns best with the protocol’s overarching ethos.

Synthetix:

- New off-chain oracles provided by Pyth Network allow Synthetix Perps fees to be reduced to 5-10bps - on par with centralized perps platforms. These oracles, pioneered by Synthetix, greatly improve the trader experience and minimize the risk of front-running attacks. They work as follows: off-chain oracles save prices off-chain and are provided to traders by keepers when a trade is initiated, with an approx 8-sec delay due to block times. Conversely the on-chain validation process includes staleness checks, key-threshold confirm and a final check against on-chain oracles.

- Synthetix will continue to use Chainlink oracles alongside Pyth. In 2022 alone, Chainlink price feeds helped facilitate over $50B+ billion in transaction value on Synthetix.

GMX:

- GMX Perps boasts a custom oracle solution with an aggregate of prices from leading volume exchanges, so there is not a lot of certainty around the exact origin of all of its data feeds. Having an oracle provider that is as decentralized as possible is important and helps combat any transparency challenges. GMX will be the first perps exchange to use Chainlink’s low-latency oracles. This partnership will help GMX reduce trading fees, support decentralization and improve the user experience thanks to quicker execution - making it more difficult for potential front-running. Good.

To wrap this up - I revert back to the intro stance: Competition is good, as it drives industries forward and contributes to the overall health and development of the ecosystem. As well as pushing each other to diversify and innovate, competing protocols inspire change within. GMX’ simple, clean interface has inspired changes to the Synthetix UX strategy and that of our integrators, while Synthetix’ commitment to decentralization has perhaps influenced some of GMX’ decision making around oracles and fundamentals. Competition plays a super important role in shaping crypto as it drives innovation, quality, efficiency and diversity, and encourages a dynamic ecosystem that benefits users, investors, and the broader adoption of crypto and blockchain technology.

Thanks for reading and a big thank you to CC Matt and Ambassador Westie for their thoughts and contributions.