Synthetix Perps Price Impact Function

Synthetix Perps, a decentralized perps protocol, relies on several mechanisms to maintain market stability and protect liquidity providers from imbalanced markets. One such crucial mechanism is the Price Impact function, which helps Synthetix Perps simulate the behavior of traditional order books and encourages neutral markets. In this blog post, we will delve into the Price Impact function, its role in promoting market neutrality and protecting stakers, and why it's a vital piece of Synthetix's innovative risk management strategy.

Understanding Synthetix Perps

Synthetix Perps are decentralized perpetual futures contracts that leverage Synthetix Liquidity, allowing traders to gain exposure to various assets without actually owning them. Unlike traditional futures, perpetual futures don't have an expiry date, enabling traders to hold their positions indefinitely, provided they maintain sufficient margin. To ensure market balance, Synthetix Perps employs a dynamic funding rate mechanism and a price impact function. Both of these tools work in tandem to bring delta neutrality to market LP’s.

Price Impact Function: Simulating Orderbook-like Behavior

Synthetix Perps simulate orderbook depth using a simple price impact function, which adjusts the execution price based on the size of the trade and the current market skew. The price impact function creates a premium or discount on the execution price depending on the direction of the trade (long or short) and the existing market skew (long or short).

Promoting Delta-Neutral Markets

The Price Impact function encourages market neutrality by offering incentives for traders to take positions that reduce the market skew. When there's a long skew, traders going short earn a premium from traders who are long. Conversely, when there's a short skew, traders going long receive a discount, and those going short pay a premium. This mechanism incentivizes traders to take positions that help balance the market, promoting stability and reducing risk for stakers.

This mechanism creates a high-frequency rebalancing incentive and places soft limits on the maximum exposure held by the debt pool by storing premiums from takers (expanding skew) and distributing them to makers (compressing skew). This is achieved without needing explicit restrictive open interest limits.

Protecting Liquidity Providers (Stakers)

Liquidity Providers (Stakers) in the Synthetix ecosystem provide collateral and liquidity, enabling the functioning of the platform. The Price Impact function helps protect stakers by ensuring that there are ample incentives to keep markets delta-neutral for liquidity providers. This mechanism reduces the likelihood of non-neutral markets.

A Practical Example: Calculating Price Impact

Consider the following scenario:

- Current ETH long OI: 800 ETH

- Current ETH short OI: 200 ETH

- Next trade: 300 ETH short

- ETH/USD oracle price: $2000

Calculating the price impact for user shorting 300 ETH with a discount:

- Initial skew: 600 ETH (800 ETH long skew - 200 ETH short skew)

- Final skew: 300 ETH (800 ETH long skew - 500 ETH short skew)

- InitialPremium: 0.0006 (Initial skew / SkewScale) (600 / 1,000,000)

- FinalPremium: 0.0003 (Final skew / SkewScale) (300 / 1,000,000)

- ExecutionPrice: ≈ $2000.9 (OraclePrice * (1 + 0.5 * (InitialPremium + FinalPremium)))

In this case, the trader is going short, and the market has a long skew, so they receive a discount, resulting in an execution price lower than the oracle price.

The Effects of Risk Management

Effective risk management is essential in the Perps mechanism design. Liquidity providers must never be exposed to long-term skew; instead, they should utilize incentives such as Dynamic Funding Rates and Price Impact to properly encourage arbitrage traders to guide markets toward equilibrium.

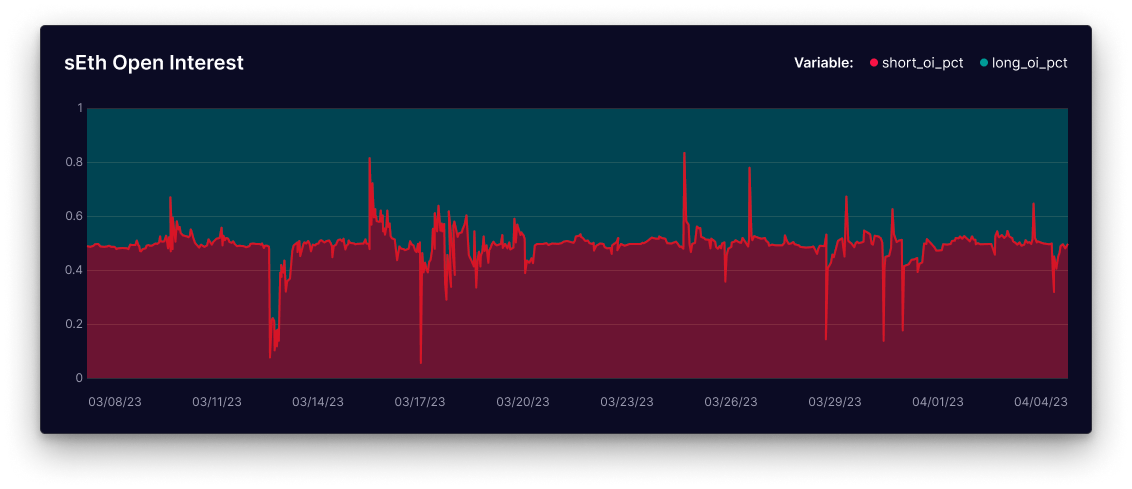

The figure above illustrates the impact of these two features on Synthetix Perps' most popular market, sETH. The market maintains continuous neutrality, and liquidity providers (stakers) act as temporary counterparties. In summary, the design is functioning as intended.

Conclusion

The Price Impact function is a vital component of Synthetix Perps' risk management mechanism. By simulating orderbook-like behavior, encouraging market neutrality, and protecting liquidity providers, it plays a critical role in maintaining the stability of Synthetix Perps.