Lyra Finance: The Leading Onchain Options Protocol

Lyra protocol provides decentralized options infrastructure utilizing Synthethix infrastructure to support margining and hedging for LPs.

Lyra protocol provides decentralized options infrastructure utilizing Synthethix infrastructure to support margining and hedging for LPs. Options are often difficult for the average user to wrap their head around compared to perpetual futures, so in this article we’ll cover all you need to know about options + how Lyra provides infrastructure to trade them.

Options Primer

There’s a million different guides to options out there right now - if you’ve never heard of them before there’s quite a deep rabbit hole to go down. At the risk of sounding like a broken record, I’ll restate some of that primer material here to help set the scene for Lyra. You can skip this section if you’re already familiar with what options contracts are.

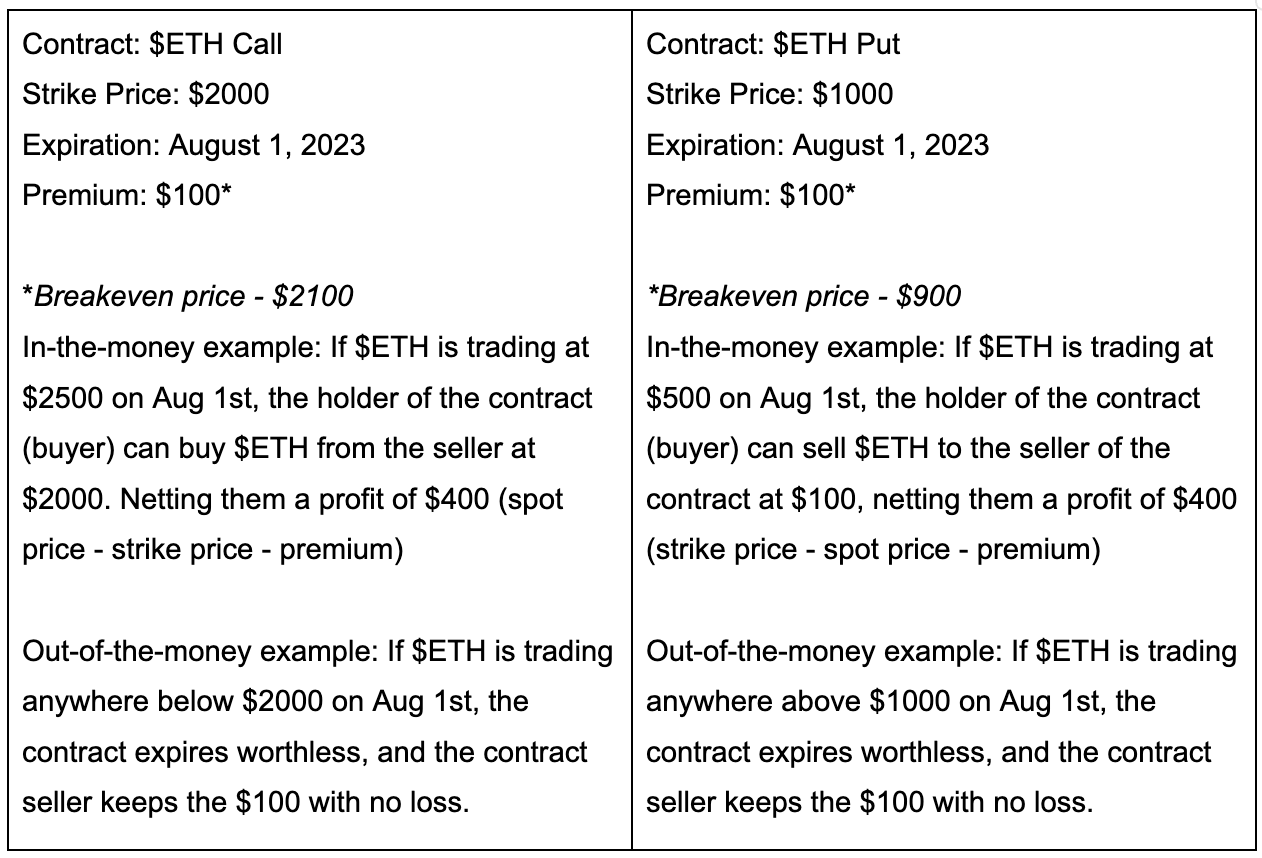

An option contract is an agreement between a buyer and a seller to buy or sell a specific asset on a specified expiration date in the future (expiry date) at a specific price (strike price). We have call options and put options - Call options represent the contract buyer’s right to purchase the asset in the future, while put options represent the contract buyer’s right to sell the asset in the future.

The seller of the contract is then obligated to sell the user that asset (or purchase it from then, for put contracts) should the contract expire “in-the-money.” The seller collects a premium from the buyer when the trade is opened (this premium is often priced by a complicated pricing model, more on that later) - and if the contract expires “out-of-the-money,” the seller gets to keep the premium and has no obligation to settle the contract. Let’s take a look at two quick examples.

So, with these two basic contracts we have 4 different trades. Buying a call (bullish), selling a call (bearish), Buying a put (bearish), and selling a put (bullish). With these four we can create a whole host of complicated strategies. Here you can find some more complex strategies, how to execute them, and what kind of biases they fit.

When putting contracts like this onchain, we’re faced with a couple of key hurdles. One of them being pricing. Current options pricing models in tradfi aren’t exactly perfect for tokens - they’re made to price options against equities. One of the key variables they look at is implied volatility, which is the market’s opinion of the underlying asset’s likelihood to change in price. Tokens are obviously orders of magnitude more volatile than equities, so if we use a common options pricing model we’ll end up with mispriced premiums and low interest from buyers/sellers

The second hurdle is a familiar one throughout all of defi - liquidity. The famous chicken-and-egg problem of needing to attract liquidity while simultaneously attracting demand for that liquidity is a relatively unified one for any defi protocol with a liquidity provisioning component. With options specifically - not having enough liquidity can mean less strike prices/expiries and lower open interest (OI, the sum total of all open trades in a given market) caps for traders.

Lyra

Lyra offers options trading against $ETH and $WBTC on Arbitrum and against $ETH, $WBTC, $ARB, and $OP on Optimism. Lyra options are European-style, meaning they can only be exercised on the expiration date (as opposed to American-style, which can be exercised on or before the expiration date). Lyra segments liquidity providers from options buyers/sellers, allowing any arbitrary trade to be filled even without a direct counterparty, as long as the asset + strike price is supported.

Providing Liquidity on Lyra

Lyra employs a peer-to-protocol approach where LPs deposit stablecoins into market maker vaults (MMVs) for specific assets to collect trading fees and hedged trader PnL by serving as a counterparty for all traders. In order to protect LPs from a particularly one-sided trading environment, Lyra also hedges for LPs via GMX (for traders on Arbitrum) or Synthetix (for traders on Optimism). On Optimism, for example, LPs would deposit $USDC (this gets swapped to $sUSD if needed to hedge) or $sUSD in an MMV. If Lyra traders have a heavy long bias unprotected MMV vaults would be forced to have a heavy short bias to fill those trades.

In order to deposit/withdraw liquidity on Lyra, LPs need to first signal the intention to do so - a three-day cooldown is then initiated where the funds are locked and then deposited after the cooldown period. The protocol has circuit breakers in place to maintain payouts for LPs + liquidity for traders in case of insolvency. In this scenario, withdrawals/deposits may be blocked (although, additional deposits can be manually approved should they be blocked for long enough).

Synthetix’s Role

Synthetix plays a crucial role for Lyra on Optimism. Lyra utilizes Synthetix Perps to hedge their options AMM using perps positions on Synthetix in order to maintain a delta-neutral position in MMVs, thus protecting their LPs from unnecessary directional risk should options traders have a heavy long or short bias.

Tangentially, Kwenta also offers a frontend for trading options using Lyra - making it a one-stop shop for trading Synthetix perps and Synthetix-margined options.

APYs for LPs can range between 8% - 40%, depending on market conditions and which market you choose to provide liquidity for.

Pricing

Accurately pricing options is a crucial component of a successful options protocol. Price too low, and options sellers won’t be interested. Price too high, and options buyers won’t be interested. Options pricing is traditionally done using the Black-Scholes model, an equation that takes in 5 inputs - the only one that requires any tweaking to make the model fit for onchain options is implied volatility, or IV (the other inputs are asset price, strike price, time-to-expiry, and the risk free rate. Each of these can be applied as they would in any other options exchange). IV is a number that represents the market’s opinion of an underlying asset's likelihood to change in price and is different across each strike price + expiry based on supply/demand. Lyra IV calculation centers around increasing IV when demand for an option with a specific strike + expiry is high and decreasing IV when supply is high.

The above sentence is a pretty big oversimplification, so let’s dig a bit deeper. Lyra initializes a baseline IV for the ATM (where strike price = spot price) option at a given expiry using current market data. This can be extrapolated to other strikes within the same expiry by increasing/decreasing baseline IV per each trades within that expiry (relative to total number of trades). This new baseline IV is then divided by the original to determine skew ratio - which in turn tells us that skew ratio times original IV can give us an equation for determining IV for any strike with the same expiry.

There’s one other bit about pricing worth mentioning - Lyra’s management of Vega risk. Vega is a measure of a contract's sensitivity in price to changes in the IV. Since there is a limited amount of liquidity in the MMVs at any given time - there’s a certain amount of Vega the system can safely take on without putting LPs at risk of insolvency should IV move too much. To prevent this - Lyra charges a fee (or offers a discount) to help the system maintain net-zero Vega for MMVs.

So in summation - IV is the major unknown factor in determining an options price (you can think of trading an option as trading IV). Lyra protocol determines IV by initializing a baseline value for the ATM strike, then has that dynamically change based on demand + extrapolates it to other strikes within the same expiry (+ repeats the process for other expiries). In addition - there is a flat fee/discount on top of the options price to maintain the system having neutral exposure to Vega (i.e, less exposed to big volatility swings).

Trading

Lyra and Kwenta both offer (similar) interfaces for trading options using the Lyra Protocol. Currently, they offer expiries up to about 2 months in advance, with anywhere from 1-10+ strikes per expiry. The trading rewards program was also overhauled in April 2023 - currently, traders earn rewards in proportion to their fees in $OP and $LYRA (they were also paying out $ARB to Arbritrum traders up until recently - now paying $LYRA). They can also earn greater rewards by trading shorted dated contracts and/or holding contracts until expiry. These rewards can be boosted by up to 2.5x by having a higher trader score (resets daily), staking $LYRA, or referrals (up to 1.2x, referrals also offer trading fee discounts like most derivatives platforms).

If you remember from our two examples above - selling (either a call or a put) would require exercising the buyers contract at expiry. This means that selling options requires some level of collateralization to ensure proper settlement. The recent Newport upgrade allowed for partial collateralization of selling options on Lyra - done so in either or the quote ($USDC/$sUSD) or the base asset ($ETH/$BTC/etc.). There are a couple of notable limitations to trading, namely:

- Traders cannot open positions for options expiring in under 12 hours

- Traders cannot open trades that have deltas (delta is a measure of how much the value of an options contract will move given a $1 move in the underlying asset) outside a specified cutoff range

- For closing trades that are outside these two parameters - they must do so using the ForceClose mechanism, incurring a penalty

Remember also that fees dynamically reflect the net total IV in the AMM - so they are also subject to additional fees should trades exacerbate the Vega.

Tokenomics

$LYRA is the governing token of Lyra protocol. Staking allows for participation in governance (or delegation of governance) as well as boosted yield to MMV positions, $LYRA emissions, and a multiplier for trading rewards.

The process of unstaking is a bit different than what you might be used to. You first need to signal your intent to unstake, at which point a 14-day cooldown is initiated - during which the rewards are disabled. After this cooldown, a two-day window opens where the staker needs to confirm their action in order to unstake. If this window passes without unstaking, their tokens will be staked again and subject to another 14-day cooldown should they try to unstake again.

The Future of Lyra

Lyra recently announced their v2, consisting of an OP-stack based rollup offering spot, perpetuals, and options trading. This appchain comes with a whole host of upgrades to Lyra, including but not limited to:

- Portfolio margin, cross-margin, and multi-asset collateral

- Capital efficient spreads for options

- Gas fees from the Lyra Chain accruing to Lyra DAO

- An offchain matching engine

- Account abstraction

- Partial liquidations

- A brand new UI

Read more about Lyra v2 here. The early access program is also accepting sign ups currently, you can sign up here. Lyra has done over $500m of notional volume to date, making them the largest onchain options dex by a large margin. To put that into perspective in the larger market - Deribit, the largest centralized crypto options exchange, clears four billion USD in volume weekly. It’s clear decentralized options still have a long way to go, but with names like Lyra leading the charge there’s clearly lots to be excited for.