SNX Staking Reward Updates

An explanation of the recent changes to the SNX Staking Rewards.

Update (November 11, 2019): some of the content in this article is no longer up-to-date. Please check the blog for more recent information.

We recently made some adjustments to our monetary policy through the addition of SNX staking rewards, designed to incentivise SNX holders to contribute to the system by minting Synths. Having continued the internal discussions about the implementation of these changes, we have made two updates to the reward mechanism.

The two changes we have made to staking rewards are the following:

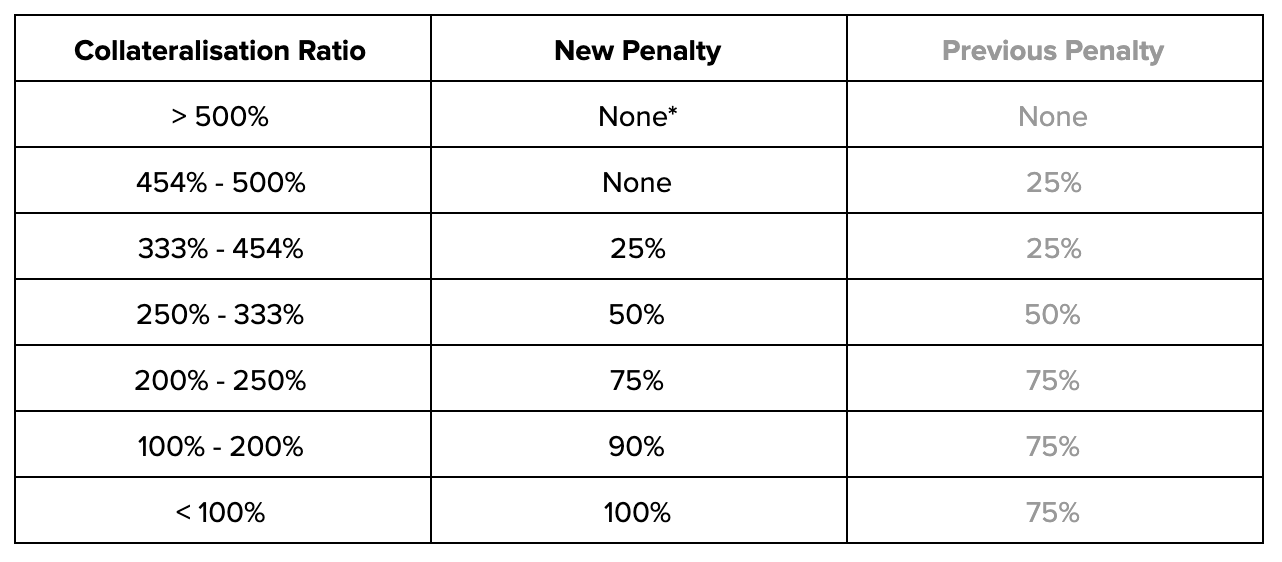

- We have added a buffer to protect minters from small SNX price fluctuations, which means your collateralisation ratio can now drop to 454% before you are penalised.

- We have added greater penalties if your c-ratio is below 200%, which means there is even more incentive to contribute to the system by fixing your c-ratio. .

If you’re wondering why the cut-off for the no-penalty buffer is 454%, it’s because the Synthetix system measures c-ratios inversely (i.e. it measures the ratio as sUSD / SNX rather than SNX / sUSD). This means the first penalty kicks in if your (inverse) ratio is at 22%, which is the equivalent of 454%.

We’ve also received a few questions in Discord around why SNX staking rewards aren’t yet claimable through Mintr. As we communicated earlier, there’s a delay in the ability to claim, but it will be made available within the first 6 week claiming period (March 19 - April 30). It will be retrospectively claimable, meaning you can claim for all the reward weeks (up to 6 weeks in arrears) that have passed. These rewards will be escrowed for 12 months.

*There is no 'penalty' per se for being over-collateralised above 500%, but you will receive a lower proportion of rewards (SNX staking rewards and Synth trade rewards) because your contributing proportion of the total minted supply will be lower than if your ratio was 500%.

Website | Synthetix.Exchange | Mintr | Discord | Twitter