Upcoming Debt Pool Synthesis

Oh, the moment you've all been waiting for: Debt Pool Synthesis. Both debt pools will become one on March 24th, starting between 9pm-11pm UTC. Once complete, the update will be announced as such.

Once Debt Synthesis and the debt pools are merged, two key results affect stakers:

- SNX inflationary Staking Rewards will be provided proportionally to all stakers. There will be no SNX reward difference between staking on Optimism or Mainnet Ethereum. sUSD (trading) fees will still be rewarded based on network staked

- Debt Hedging will no longer rely on debt on the network you're staking on; it will depend on the synthesized debt pool.

Merging the debt pools is necessary to provide maximum liquidity across the protocol and transfer synths between multiple chains efficiently via cross-chain messaging, rather than relying on automated market makers (which are limited by the depth of their liquidity pools and subject to slippage).

Debt Pool Synthesis allows the protocol to have fungibility on both L1 and L2.

Timeline Summary

- Debt Pool Synthesis has been released, this has begun the process of merging the debt pools.

- March 24th starting at 9pm UTC, Chainlink oracles for debt pool tracking on L1/L2 will be activated. Effective immediately, the debt pools will have merged into one.

- Announcements will be made regarding the new unified debt pool composition to allow stakers to hedge their debt.

Debt Hedging

As said earlier, instead of debt hedging being reliant on just the network you're staking on, all stakers will have to hedge against the assets in the new unified debt pool.

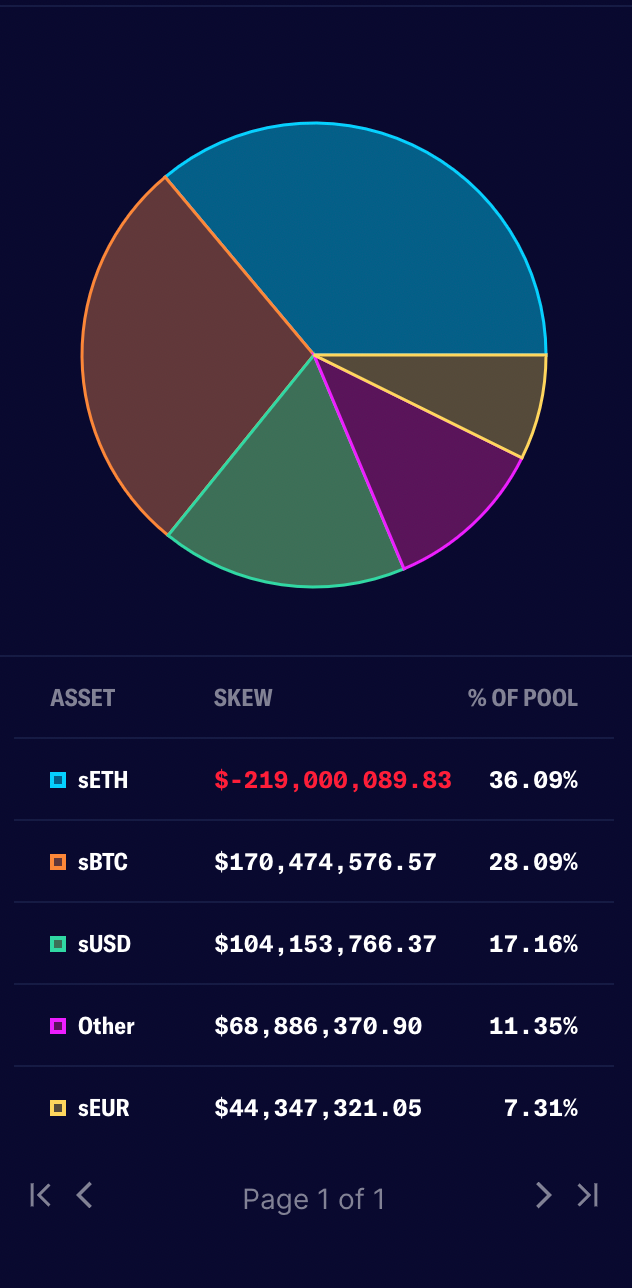

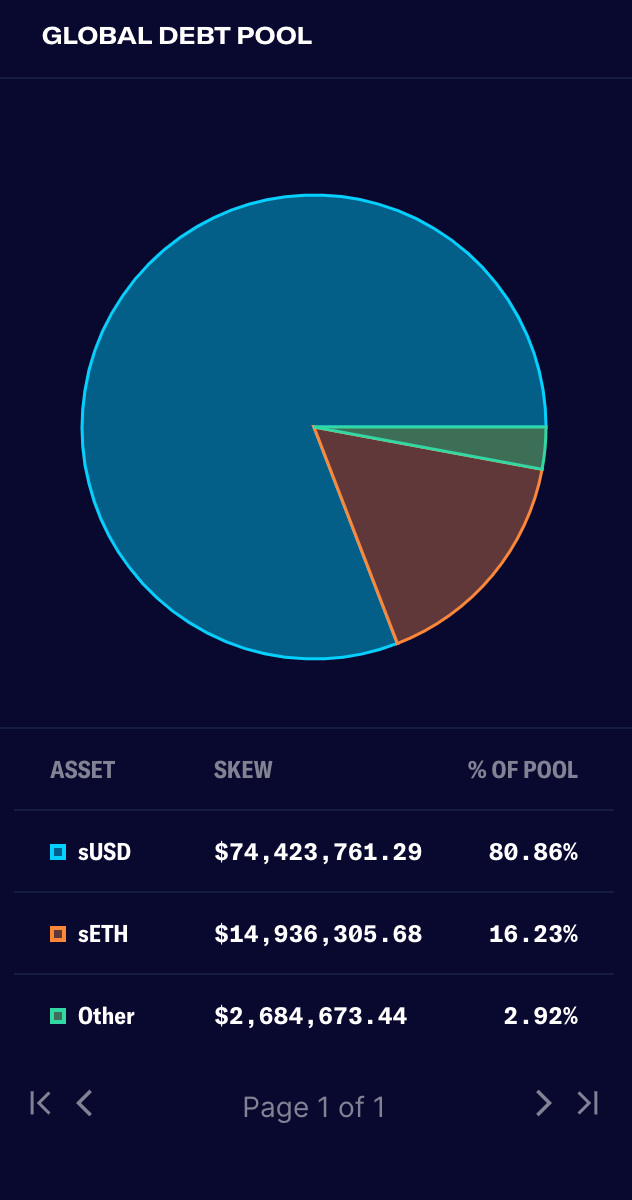

The current composition of the two debt pools is as follows

L1:

L2:

According to these numbers, the debt pool would be combined to look approximately like this:

sETH: 31% Short

sBTC: 25% Long

sUSD: 27% Long

Other Assets (batched together): 11% Long

sEUR: 7% Long

You would have to match the overall composition of the combined debt pool to be properly hedged. Both shorting and longing of assets can be done on Kwenta.

(Note: These numbers change often, subsequent announcements will be made regarding the composition following the synthesis. )

Look at the easier to understand example below to see how to hedge your debt:

Ex: If the combined debt pool is 25% sETH and 75% sUSD, you'll need to own roughly the same assets as the debt pool. To do that, head to Kwenta to exchange approximately 25% of your sUSD debt into sETH.

Debt Oracles

Chainlink oracles will provide the ratio between the total issued synths and the total debt shares across all chains and then update these values across all chains. It is crucial that one oracle reports the ratio rather than the individual values separately to minimize front-running opportunities.

Fungibility with Synth Teleporters

After the Debt Pool Synthesis is complete, SIP-204 must be passed to introduce fungibility of Synths across the two networks. Standard bridges do not support a combined debt pool because the usual way to transport tokens between L1 and L2 is to lock them on one network and create a new IOU token on the other network. The issue with this is that this would require any debt calculation to ignore the Synths in the bridge; this presents integration issues for other networks who may not be aware that the total supply of Synths is not readable from the token contract.

The solution is to burn the Synth on one network and re-mint it on the other network; this is vastly superior because it's highly capital-efficient, and there is no chance of running out of liquidity for a cross-chain transfer.

Transfers between L1 and L2 would be instant on both sides, with no 7-day Optimism delay for bridging between L2 and L1.

Protocol Upgrade Summary

Here's a quick summary of the various parts of the SNX network that will be upgraded/changed by the Debt Pool Synthesis.

- SNX Rewards: SNX rewards will be provided to users proportionally on the networks that they are using to stake. This means that, in a given fee period, a staker will receive the same SNX rewards regardless of how their staked funds are distributed across chains (as the percentage of debt shares that they own is agnostic to this distribution).

- sUSD Rewards: sUSD rewards will be provided to users on the network the fees are generated on. This means that, in a given fee period, a staker will receive more sUSD rewards if they are staked on a chain with more exchange activity. This is the most elegant solution (as we don't need to communicate exchange fee volumes cross-chain) and incentivizes users to provide liquidity to the more active chain.

- Synth Issuance: The issuer will now rely on the totalDebtIssued and totalDebtShares reported from the oracles rather than the equivalent values provided by the debt ledger and the debt cache.

- Fee Pool Closure: The fee pool must be updated via cross-chain communication. Initially, L1 can use the Optimism Messenger to trigger the closure of the fee period on L2. Ultimately, this can use a cross-chain broadcaster to support additional chains.

- Loans: The interest rates charged on loans are determined by examining an aggregate skew in the system. This may be difficult to compute accurately across two chains. It should be verified that the behavior of the loans contracts only examines the skew on their own chain, not involving the full cross-chain debt, if it isn't feasible to account for it properly.

Any Questions?

Read SIP-165 for further details on the Debt Pool Synthesis

If you've got any comments or questions about the release, please join the conversation in Discord.