Chainlink decentralizes first wave of Synthetix price feeds!

All the details around the new, live integration with Chainlink

We are extremely excited to announce that the Synthetix-Chainlink integration is now live on Ethereum, providing accurate, decentralized price feeds. This represents a major breakthrough in end-to-end security for DeFi applications, as one of the first working products to decentralize both the smart contract execution and the data oracle layer.

By offloading data feeds to Chainlink’s decentralized oracle networks, Synthetix assets will be driven by reliably tamper-proof inputs, greatly contributing to the project’s goal of censorship resistance. Traders on Synthetix.Exchange can now trade a selection of synthetic assets with infinite liquidity and no slippage, with the comfort of knowing their prices are being transferred on-chain by a pool of independent nodes backed by economic incentives, rather than any central party.

The launch of this partnership is a major step forward for DeFi protocols, demonstrating that oracles, previously a potential point of failure, can be solved by blockchain technology. It proves that projects requiring external price feeds can be migrated to the blockchain without jeopardising the ecosystem’s core principle of decentralization.

Synthetix founder, Kain Warwick, says this partnership is one of the most significant milestones so far in the project’s history. “Given our reliance on regular price feeds for our derivatives trading mechanism, finding a robust decentralized oracle solution has always been at the top of our priority list. Chainlink delivers the solution, deployed by an excellent team and supported by an invaluable community.”

As this is the first iteration of the integration, a select group of Synthetix’s FX and commodity price feeds have been chosen for the initial deployment:

- AUD/USD (sAUD — Australian Dollar)

- EUR/USD (sEUR — Euro)

- CHF/USD (sCHF — Swiss Franc)

- GBP/USD (sGBP — Pound Sterling)

- JPY/USD (sJPY — Japanese Yen)

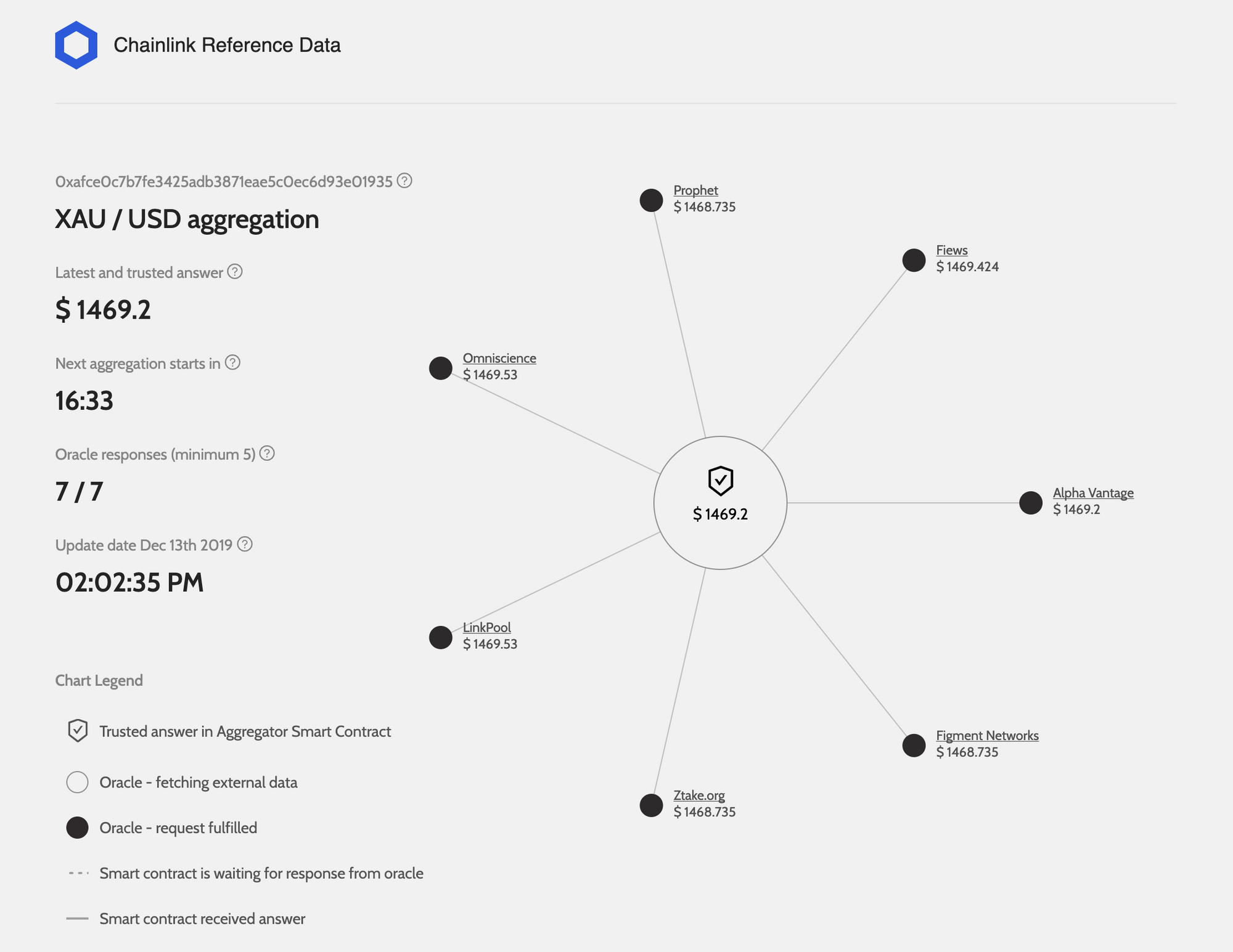

- XAU/USD (sXAU — Gold per ounce)

- XAG/USD (sXAG — Silver per ounce)

The first wave of assets are FX currencies and commodities, which are important to users visiting Synthetix.Exchange for the first time, given that many traders already have experience trading them. Decentralizing these price feeds allows traders on Synthetix.Exchange to gain exposure to more traditional assets on-chain, while remaining in full custody of their funds, a first for the cryptocurrency space.

Each of the asset links above provides a detailed look into the oracle network that’s securing the particular price feed. To maintain decentralization, Synthetix is working with numerous independent Chainlink nodes that are spread out among the seven price networks. Each node has been security reviewed and has a proven track record of successfully providing data to Chainlink’s Reference Contracts for several months without any security or reliability concerns. As the Chainlink network expands, Synthetix will look into further expanding the number of nodes and/or diversifying the nodes used to prevent overlapping within the oracle networks if necessary. Effectively, Chainlink’s oracle network can help Synthetix.Exchange scale in a secure and customizable manner as the value secured by Synthetix increases.

Given FX markets close over the weekend, and there is currently no mechanism to pause trading, there is a small chance of a positive black swan event if a fiat currency is expected to experience major price appreciation over a weekend. The Synthetix team is aware of this possibility, and is investigating solutions.

To ensure accurate data feeds, the oracles will update the on-chain price based on a price deviation model, as well as a minimum time-based update. Since maintaining accurate prices during times of high volatility is extremely important for the security of every DeFi application, the oracle networks will update the price on-chain every 1% change from the previous price. It will also provide an on-chain update at a minimum of once every hour even if volatility is low. We believe this is the strongest model to date in the DeFi ecosystem and will continue to improve as both teams work together to fine-tune it for maximum security and effectiveness.

Once these live assets have been proven to work successfully with Chainlink’s inputs, Synthetix and Chainlink will look to integrate another wave of synthetic assets, including cryptocurrencies and indices. As mentioned by Kain in an interview with Crypto Finder, in the future Synthetix hopes to decentralize the selection process for assets by enabling the Synthetix community the ability to approach Chainlink’s network of nodes and request new asset price feeds, as opposed to the Synthetix team managing the entire asset-listing process. This is yet another way Synthetix is focused on continuing to decentralize the platform and remove any central point of control.

“We are very excited to work closely with Synthetix to help further decentralize their platform using provably secure data oracles,” says Chainlink Co-Founder, Sergey Nazarov. “This integration is an evolution in DeFi applications, which showcases how decentralized financial products can maintain end-to-end security via reliable oracles and tamperproof data feeds. Decentralizing maintenance of data feeds is one of the next leaps for DeFi, and we are thrilled about being part of helping add this additional level of decentralization to a market-leading decentralized application like Synthetix.”

Further information:

Learn more about Synthetix by reading the litepaper, visiting the website, following on Twitter, or joining the Synthetix community on Discord.

Learn more about Chainlink by visiting the Chainlink website, Twitter or Telegram. If you’re a developer, visit the developer documentation or join the technical discussion on Discord.