Wick Insurance: Protect Your Trades From Scam Wicks

Insurance for crypto’s most unfair moments

The most frustrating thing for any perp trader is being directionally right on a position, but getting liquidated at the pico top/bottom of a move.

A single malicious wick, a flash crash, or a fat-finger sell on a low-liquidity pair can wipe out your position in milliseconds - even if the price snaps back 10 seconds later. You’re left rekt, while the market immediately recovers and runs in your original direction.

It’s not bad risk management. It’s the nature of 24/7, hyper-leveraged markets.

Until now.

Introducing Wick Insurance — The First Real Protection Against Scam Wicks

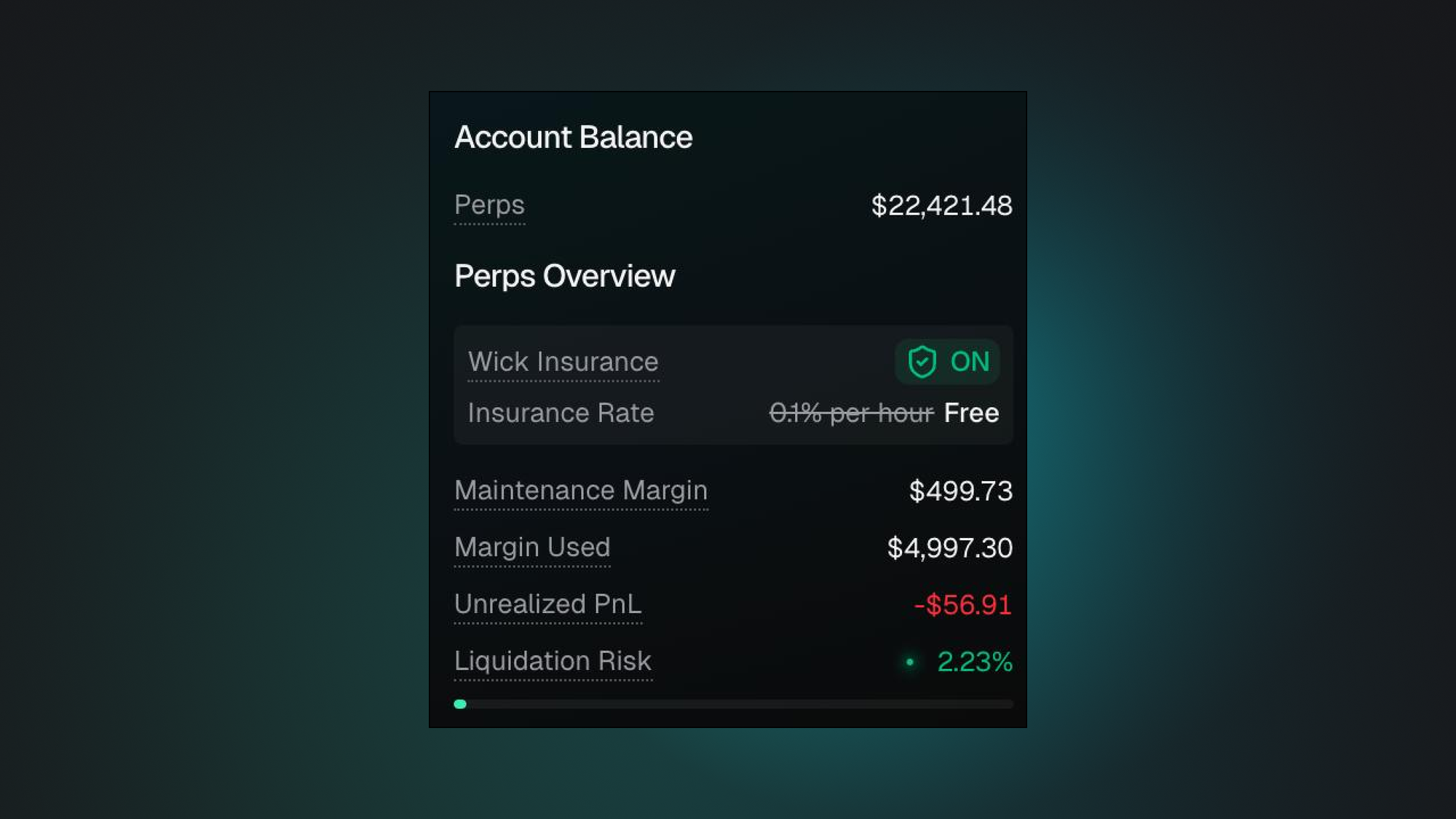

Wick Insurance is a novel feature that gives you a configurable grace period when your position temporarily breaches your liquidation level. Instead of instantly zeroing your account, Synthetix’s wick insurance will disable liquidations for a short period of time, allowing the market to prove whether it was just a wick or a real move.

If the price recovers and your margin health is restored within that window → you’re unfrozen and back in the trade. No liquidation.

If the move is real → liquidation happens normally, just delayed by minutes.

It’s insurance designed specifically for crypto’s most unfair moments.

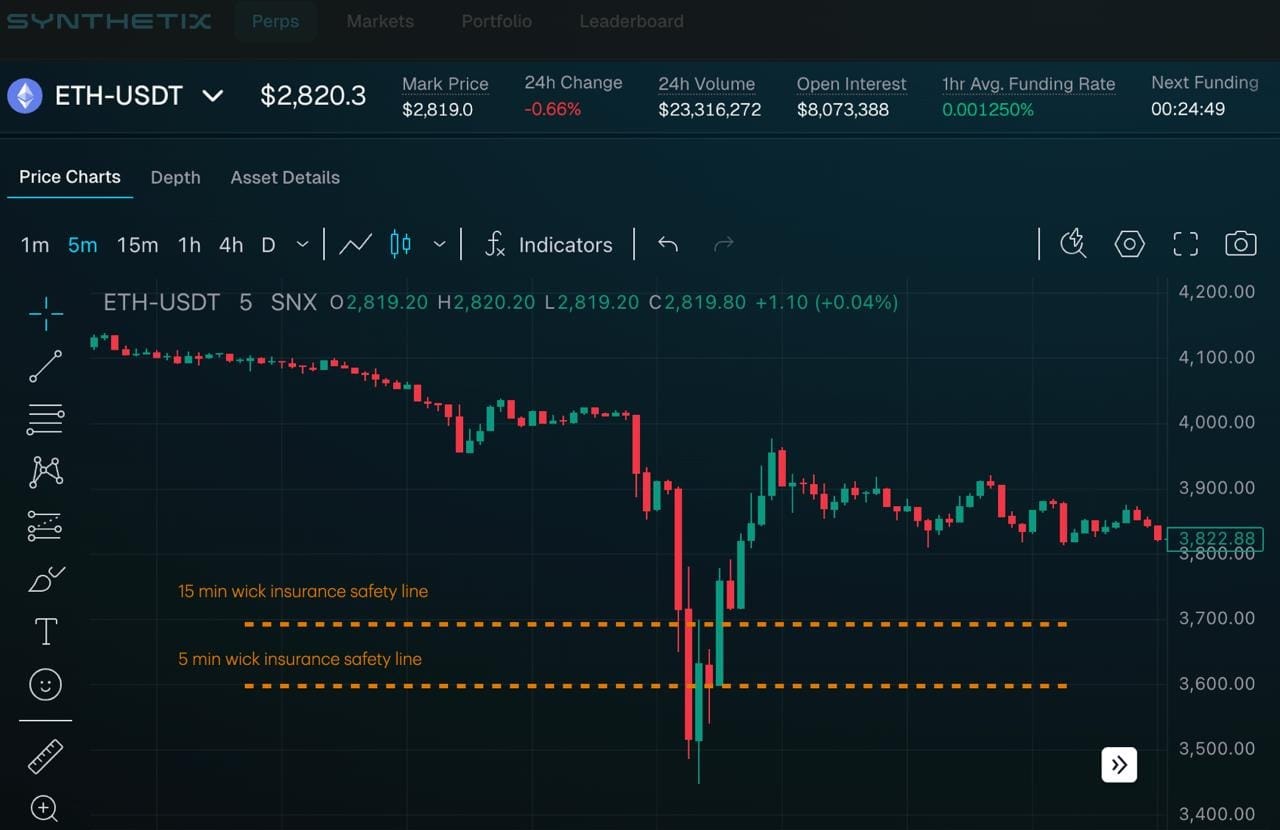

Remember, Remember the 10th of October

10/10 was one of the most violent single-day liquidations in crypto history. In less than 45 minutes during the Asian session:

- BTC plunged over 14% from highs near $126,000 to as low as $104,782.

- ETH fell roughly 20%, with altcoins like Solana and Layer-2 tokens cratering 30–70% in flash drops.

- The largest day of liquidations saw a staggering $19 billion in leveraged positions wiped across exchanges.

And then?

Amazingly, the move almost completely reversed within hours. BTC clawed back above $112,000 by day's end, and altcoins bounced 10–33% from their lows, turning what could have been a multi-week bloodbath into a brutal but fleeting shakeout.

Yet thousands of traders got obliterated by structural failures that led to a short and sharp liquidation cascade that saw prices tank and bounce.

With Wick Insurance active on ETH-USDT that day:

- A trader with 5-minute insurance would have survived with a liquidation price above drop below $3,600.

- Anyone running 15-minute insurance would have survived with a liquidation price above $3,700

- Accounts would have unfrozen as price recovered, letting them ride the rebound that liquidated everyone else.

10/10 wasn’t a bear market. It was mostly a wick event.

And Wick Insurance is a potentially helpful safeguard against violent moves like this.

What This Actually Means for You as a Trader

- Trade with real conviction again: You can finally size properly on high-conviction setups without the constant fear of getting “wick-hunted.”.

- Survive flash crashes & fat-finger events: We’ve all seen it: a $200M market sell on BTC, price drops >3% in a minute(s), then recovers fully in two minutes. Thousands liquidated. With Wick Insurance, most of those traders would have survived and profited.

- Hold through short-term manipulation: Low-liquidity altcoin pairs are notorious for wicks that trigger liquidations. Wick Insurance neutralizes this.

- Peace of mind = better decision making: When you’re not terrified of a 2-second candle destroying your account, you stop over-managing positions, revenge trading, or closing winners too early.

How It Works (in Plain English)

- When a trader turns wick insurance on, they will select from a list of pre-defined time periods they wish to protect against scam wicks.

- When your account would normally be liquidated, Wick Insurance kicks in automatically when turned on.

- Your account enters a brief “frozen” state: no new trades or withdrawals, but your existing position stays open. You can even deposit during this state to increase your margin and recover from liquidation.

- If price recovers and your margin is healthy again before time runs out → everything unfreezes. You keep trading like nothing happened.

- If the move is real → liquidation happens exactly as before, just a few minutes delayed.

Think of it like a circuit breaker for your personal account, but smarter.

Built for Degens, Backed by Math

This isn’t charity. The protection is priced dynamically and fairly using real risk models, so protection on higher leverage and more volatile assets will cost more.

And the platform is protected too: strict exposure caps, auto-deleveraging backstops, and cooldown mechanics prevent gaming.

Note: This is an experimental feature being tested in Season 2 of our trading competition and may not be immediately rolled out with public launch.

A New Superpower in Perps Trading

For the first time ever, you can trade leveraged crypto perps with a safety net that actually understands how crypto moves — violent, manipulative, and often temporary.

No more watching your perfect setup get stopped out by a wick, only to watch as the price rockets 20% without you.

No more “I was right but got wicked out” coping.

Wick Insurance isn’t just a feature. It’s an upgrade crypto leverage traders have been waiting for - as evidenced by the passionate response on 10/10.

Welcome to Wick Insurance, where your position is protected.

Join the Community

Follow Synthetix as we speedrun to mainnet.

Join the conversation: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Follow on X: x.com/synthetix