Understanding the Havven token sale

A question we get asked frequently is “How much does one havven token (HAV) cost in the token sale?” The simple answer is “Approximately $0.50 USD,” but there are a number of variables affecting the final price based on your individual discount. $0.50 USD is calculated from the simple maths of taking the token sale hard cap of $30m, and dividing by the number of tokens in the sale, 60m. However, due to discounts, an individual’s final price per token will vary. We will discuss these discounts below.

Discounts

Two levels of discount have been available previously.

Firstly, there was a 60% discount available during our seed round (August-September 2017). This round occurred before the white paper had even been written, based solely on the initial concept. This discount was substantial because of the equally substantial risk involved in participating at such an early stage in the project. To reduce the impact of the discount on future purchases we limited this round to $500k USD.

The second was the 30% discount during the Expressions of Interest (EOI) period (January 2018). In this phase participants nominated an amount they wished to purchase at the 30% discount. During the token sale, these participants may (subject to demand) be able to purchase up to the USD amount nominated during the EOI period at the 30% discount, but they will not receive the discount for purchases above this quantity. For example, if Alice nominated $1000 USD in the Expressions of Interest period, and then purchased in the token sale, she would receive tokens at a 30% discount, this is calculated as $1000 / 0.7 = $1,428.57 in purchasing power.

How the various discounts interact

Because there will be a combination of 60% discount + 30% discount + main sale discounts, the price per HAV will vary between participants. The more people who purchase at a discount, the higher the final price for a non-discounted token, even though the average price per token of $0.50 is constrained by the hard cap. We introduced a discount structure for the main sale in order to offset this, the discounts are based on a lockup period for each purchase.

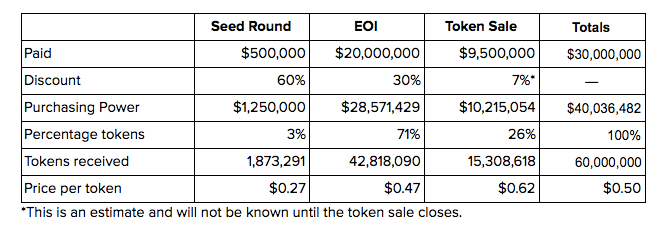

The EOI period saw over $25 million USD in registrations, though the total purchases in the token sale from EOI participants may be lower than this. If $20 million USD from the EOI period is purchased during the token sale, there would be a total of ($20,000,000 / 0.7 =) $28,572,000 USD in purchasing power across those participants. During the seed round $500k USD was purchased at a 60% discount, so collectively those participants have $1,250,000 USD in purchasing power.

That is a total of $29,822,000 USD in purchasing power from $20,500,000 in actual purchases. Since only $30,000,000 in actual purchases are possible this leaves $9,500,000 USD for the main sale.

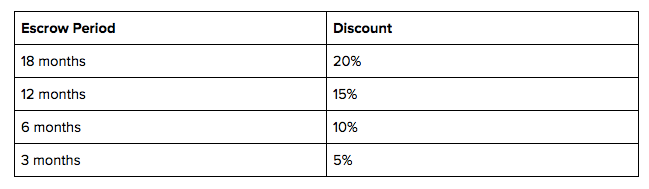

Escrow Discounts

On top of the various discounts that are determined by when you purchase your havven tokens, there is also a discount mechanism determined by whatyou do once you’ve made the purchase. It is important to incentivise those who believe in the long term success of Havven. To achieve this we will offer discounts to participants who elect to escrow their havvens for a fixed period. These havvens will automatically issue nomins and will receive fees.

The discount for escrowing will be as per the table below:

Participants will be able to choose a blend of escrow periods. For example, someone might choose to escrow 50% of their tokens for 18 months, with the rest issued immediately after the token sale — this would yield a discount of 10% across their tokens. This approach is intended to reward commitment to the system.

Price Calculations

There are a total of 60,000,000 tokens to distribute among token sale participants. To work out who pays what, we need to establish what each group of purchasers pays per HAV token. Those with the 60% discount have $1,250,000 in purchasing power, so we need to divide the effective purchase total by that figure to determine how many tokens they receive. $1,250,000 / $40,036,482 = 3%. Once we know what percentage they receive, we can establish how many tokens the seed round participants receive in total: 1,873,291. And then we can establish the price per token for those participants: $0.27 USD. The table below illustrates the price for each part of the sale.

(Please note: the above table is a guide only — the exact details and prices will not be known until closer to the sale)

Summary

In conclusion, the various combinations of when you purchased HAVs, when other people purchased HAVs, and to what extent you and others escrow your HAVs, will all determine the price you pay per token during the token sale. This discount structure has been designed to provide a fair and transparent access to tokens at various stages of the project. Critically, no discounts were offered based on volume purchases. During the Expression of Interest phase we had over 500 expressions of interest of less than $5000, this means that all of these participants may be rewarded for supporting a project early without having to make a huge purchase to participate. Of course no sale mechanism is perfect, and we have the problem of a hard cap that will mean not everyone who wants to purchase will be able to. Vitalik calls this the “the first token sale dilemma” in his article on token sale models which can be found here. If you want to understand the tradeoffs between token sale models, it is a great read.