Token Sale Review

The Havven token sale raised USD$30m and successfully hit the hard cap. This was a combination of USD$26m during the Expression of Interest (EOI) period (26 February — 27 February, 2018), and a further USD$4m during the token sale (28 February, 2018). The final USD$4m was purchased within 90 minutes of the sale opening. This article will provide a comprehensive overview of the token sale.

Please note: the distribution of all tokens, from the airdrop and bounty campaigns and the token sale, is now complete.

EOI Sale

- To make a purchase in the EOI period, registration needed to be completed on the Havven website between 8 January and 31 January, 2018.

- All purchasers in the Havven EOI were required to be whitelisted between 19 February-25 February 2018 by passing a know-your-customer/anti-money-laundering (KYC/AML) check.

- A total of 1277 people registered interest.

- 191 people made a purchase during the EOI period.

- The average purchase in the EOI sale was USD$136,125.65.

Token Sale

- All purchasers in the Havven token sale were required to be whitelisted between 19 February-25 February 2018 by passing a know-your-customer/anti-money-laundering (KYC/AML) check.

- A total of 24,313 people were whitelisted.

- 1,734 people made a purchase.

- The average purchase was USD$2310.43.

- Token sale purchases were capped at the ethereum (ETH) / bitcoin (BTC) equivalent of USD$5000.

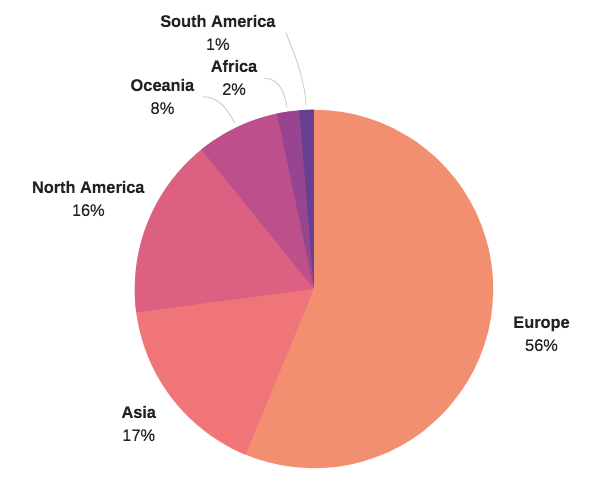

- Buyers from 86 countries made purchases in the token sale. Below is an illustration of the continental distribution:

Token Distribution Model

- Fixed supply (100,000,000 tokens)

- Proportional distribution sale (no tokens burned)

- The EOI was open to anyone who registered during the EOI window with no minimum purchase required

- EOI interest was high leaving USD$4m available for the token sale.

- On February 11 we proposed raising the hard cap from USD$30m to USD$40m to enable more people to participate, as the new tranche of USD$10m would have an individual cap of USD$5,000. However, after listening to the feedback from the Havven community, the original USD$30m hard cap was retained.

Token Sale Model

- Our token sale was facilitated by TokenSoft, a white-label integrated custody solution and platform for hosting secure and compliant token sales.

- TokenSoft provided the means to carry out the KYC/AML identity checks.

- TokenSoft provided a platform that restricted access to only whitelisted participants. This involved generating a unique ‘transaction data’ code for each whitelisted participant inside the purchase flow.

Discounts

- A variety of discounts were available throughout the sale.

- Discounts were implemented in a manner that would increase the number of tokens received rather than reduce the amount of money contributed. For example, a contribution of $1000 at a 30% discount resulted in $1000 / 0.7 = $1428.57 worth of tokens.

- There was a small number of 60% discounts for those who committed to buying tokens before the release of the white paper in August & September 2017. This was capped at USD$500,000.

- There were 30% discounts for purchasers in the EOI sale.

- Apart from one strategic allocation, all EOI purchases are subject to a 12-month escrow period with quarterly vesting.

- During the token sale, purchasers chose a variety of escrow options between 3 months and 18 months for discounts between 5% and 20%.

Below is a breakdown of the escrow/discount options chosen by purchasers in the token sale:

- 18 months escrow (20% discount): 4.17%

- 12 months escrow (15% discount): 2.03%

- 6 months escrow (10% discount): 5.13%

- 3 months escrow (5% discount): 3.78%

- No escrow (no discount): 84.88%

Prices

Due to the proportional distribution model and discounts, prices could only be determined once the sale concluded. Below is a breakdown of price per token:

- Token sale (0% discount): $0.67

- Token sale (5% discount): $0.64

- Token sale (10% discount): $0.60

- Token sale (15% discount): $0.57

- Token sale (20% discount): $0.54

- EOI sale (30% discount): $0.47

- Seed round (60% discount): $0.27

Below is a breakdown of price per token in ETH values at the time of the sale:

- Token sale (0% discount): 0.000770 ETH

- Token sale (5% discount): 0.000736 ETH

- Token sale (10% discount): 0.000690 ETH

- Token sale (15% discount): 0.000655 ETH

- Token sale (20% discount): 0.000621 ETH

- EOI sale (30% discount): 0.000540 ETH

- Seed round (60% discount): 0.000310 ETH

Scams

- We are aware of 10 different ETH wallet addresses that were used for scams.

- We are aware of up to 62 transactions that were potentially sent to scammers.

- We believe scammers obtained up to 90 ETH.

- If you wish to report a Havven-related scam, please contact scams@havven.io.

Security

- Before and during the sale, we partnered with Entersoft, an application security provider, to protect our community from phishing scams.

- Entersoft shut down a total of 24 phishing sites and 17 fake Medium pages.

- Entersoft also flagged 17 digital wallets used by the scammers as being used for phishing.

- In the 24 hours before the token sale, we deployed a bot to mute the channel, which deleted all comments posted. This was to protect against scammers deploying spam bots to spam-post links to phishing sites. This muting was continued for 24 hours after the sale.