Introducing Synthetix Perps on Ethereum Mainnet

Today, Synthetix launches the canonical perp DEX on Ethereum. This marks the end of the transition phase and the beginning of the Ethereum Mainnet CLOB era for Synthetix.

As a DeFi pioneer since 2017, with years of experience innovating in synthetic assets, liquidity incentives, and decentralized stablecoins, Synthetix is returning to Ethereum Mainnet with a clean slate and a renewed focus on building the ultimate perp DEX.

So It Begins…

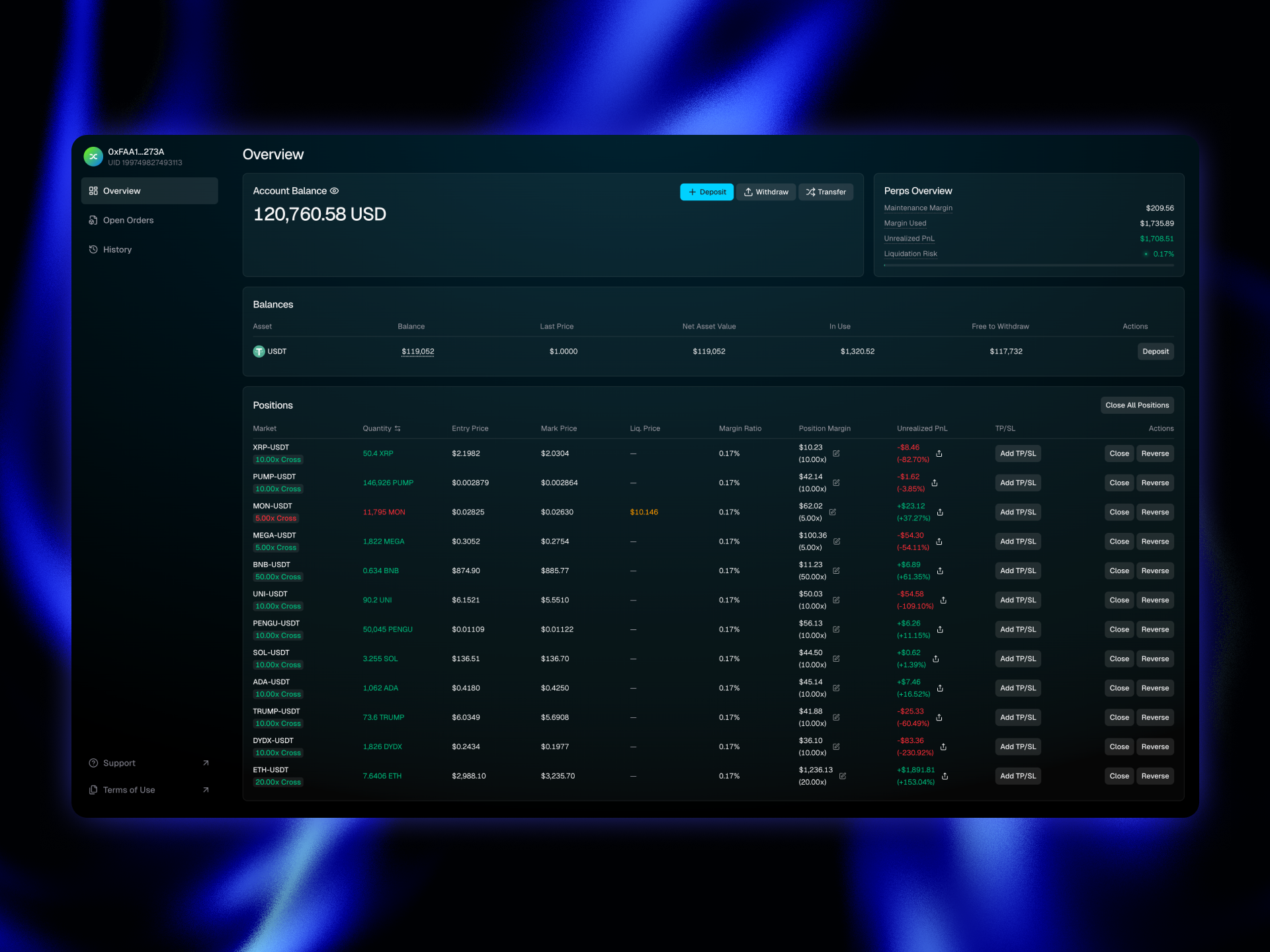

Synthetix Perps are going live on Ethereum Mainnet in a private beta.

At launch, Synthetix will support three markets: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), and up to 50X leverage on each pair. Synthetix will also be limited to a maximum of 500 users. These 500 users will consist of historical Synthetix/Kwenta power users, sUSD and 420 pool stakers, trading competition participants, and select Synthetix Teams depositors. Deposits will be capped at 40,000 USDT per user.

Please note: Withdrawals will not be enabled on day one, so you won’t be able to withdraw funds from the exchange immediately. This is a precautionary measure to monitor the onchain deposit contract. We will enable withdrawals within approximately one week following launch.

This is only a shadow of what Synthetix will look like in 3 months' time, with new markets launching weekly, more leverage, better liquidity, higher deposit caps, and more features coming Soonthetix.

Synthetix’s 2026 roadmap features a stacked lineup of novel products and game-changing new features, including:

- New markets and features every week beginning December 29, 2025.

- Multicollateral margin

- Wick insurance

- Real World Assets (RWAs)

- Deep composability with Ethereum DeFi applications

- More order types

- Partnerships with leading protocols

- Optimistic and trust-minimized orderbooks

- And much, much more

We Are So Back

We know that Synthetix still holds a special place in the hearts of the OG DeFi & Ethereum community, but it’s no secret that we haven’t delivered an inspiring vision for the last few years, leaving many to stop paying attention.

We’ve acknowledged this and have completed a dramatic overhaul of nearly every aspect of our product, marketing strategy, and core team:

- Successfully executed 2 trading competitions: Featuring hundreds of the biggest and best traders in the crypto industry, as well as core community members and historical Synthetix power users.

- During the combined 6 weeks of the trading competition period, traders generated a staggering $11 billion in volume and paid over $4.5 million in fees.

- Over $2,000,000 in prizes have been distributed to winning traders.

- Cracked new team: 18/20 team members have joined in the last 14 months.

- OG leaders Kain and Jordan have returned: adding key strategic oversight and industry expertise.

- Full-stack protocol: owning the consumer-facing product empowers Synthetix by removing dependencies and improving brand positioning in the market.

- Game-changing new strategy: CLOB not AMM, Ethereum Mainnet not L2s, delegated not discretionary staking/minting.

Why Mainnet?

Synthetix has spent the last 5 years building, iterating, and learning how to perfect the DeFi & perp experience for users on Ethereum and L2s. We learned that the L2 scaling roadmap had some harsh trade-offs for applications, and now we are laser-focused on developing a high-performance, non-custodial perpetual futures platform on Ethereum Mainnet:

- Real Ethereum L1 Asset security: Fully onchain custody, deposits, and withdrawals. No Bridging. No rehypothecation.

- Real Composability with all Mainnet assets and DeFi apps, which have the deepest liquidity and the most TVL of any singular blockchain in crypto today.

- Community market-making and liquidation vault: No insiders. No back-room deals.

- An institutional-grade Centralized Limit Order Book (CLOB): CEX level throughput and latency.

- Account data privacy: your orders and trades will not be publicly displayed.

To return to mainnet, we are utilizing a completely different architecture than anything we’ve ever done before, with offchain order matching, and batch settlement onchain:

- L1 Custody and Settlement: Users don’t want to bridge large amounts to L2, so we are using L1. User funds are custodied on L1, and trades settle directly to L1. Trader margin is managed by the offchain orderbook (for now), but onchain withdrawals are permissionless.

- Offchain Matching Engine: Institutional-grade exchanges demand high-throughput, low-latency, fault-tolerant matching engines. Neither L2s nor Solana, never mind Ethereum, has sufficient throughput to run a matching engine onchain. Our offchain engine delivers the performance professional and discerning traders expect.

We believe that operating a high-performance offchain matching engine on the most secure, decentralized, credibly neutral, and highest TVL blockchain (Ethereum) far outweighs all of the downsides of operating a fully onchain matching engine on a centralized blockchain.

Following the recent Fusaka upgrade, which was successfully activated in December, it’s clearer now than ever before that as Ethereum Mainnet scales, more functionality will migrate onchain and Ethereum will return to dominance as the central point of capital concentration for the wider crypto economy.

Join the Community

Follow Synthetix as we usher in perps on Ethereum Mainnet.

Join the conversation: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Follow on X: x.com/synthetix