Synthetix Perps Launches 14 New Perpetual Futures Markets on Base

The newly added markets include Bittensor (TAO), Chainlink (LINK), GMX (GMX), Injective Protocol (INJ), Axelar (AXL), Sui (SUI), Etherfi (ETHFI), (TIA), Stacks (STX), Arkham (ARKM), Toncoin (TON), Pendle (PENDLE), Gala (GALA), Book of Meme (BOME).

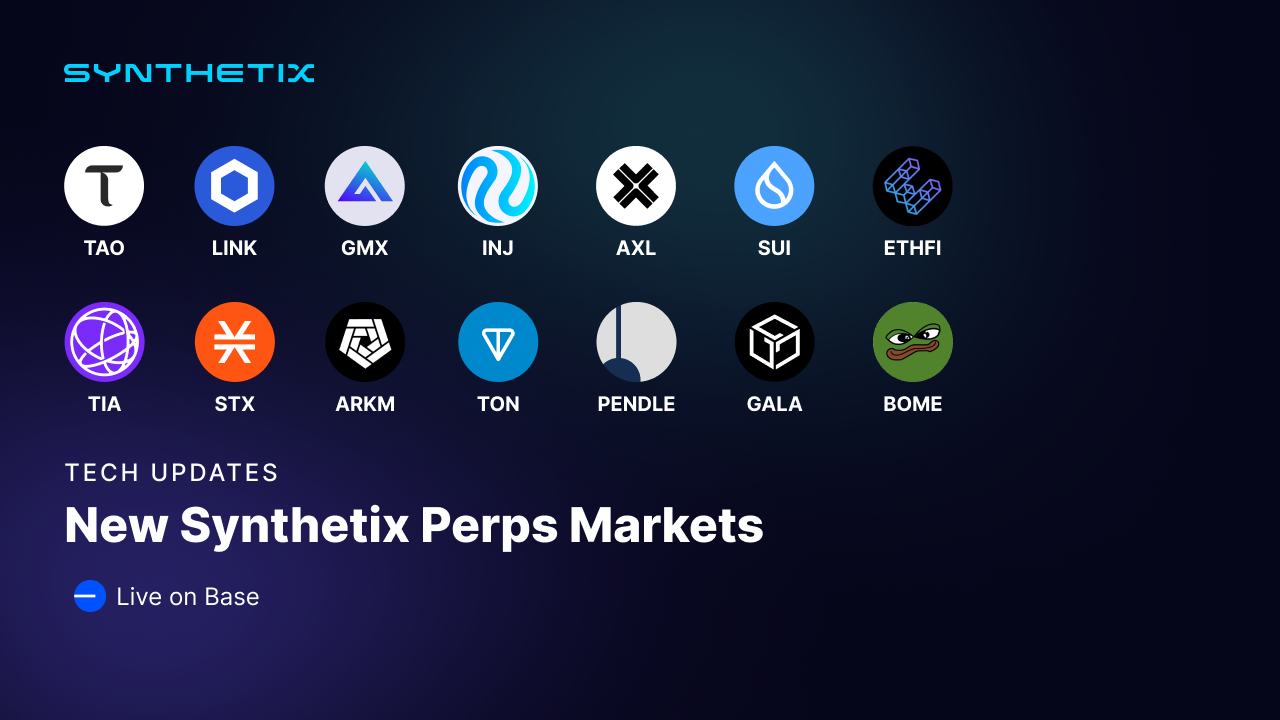

Synthetix is excited to announce the launch of fourteen new perpetual futures markets on Base.

The newly added markets include Bittensor (TAO), Chainlink (LINK), GMX (GMX), Injective Protocol (INJ), Axelar (AXL), Sui (SUI), Etherfi (ETHFI), Celestia (TIA), Stacks (STX), Arkham (ARKM), Toncoin (TON), Pendle (PENDLE), Gala (GALA), Book of Meme (BOME).

These markets were approved in SIP-370, SIP-372, SIP-375, SIP-379, SIP-380, with configurable values set by SCCP-327.

Trading Synthetix Perps on Base

The new perpetual futures markets are only available on Synthetix Perps deployed on Base. Traders can access these markets through platforms integrating with Synthetix Perps on Base, such as Kwenta.

Market Parameters and Liquidity

The specific market parameters for each new perpetual futures market, including initial margin ratios, fees, and maximum market sizes, can be found in SCCP-327. Liquidity providers can earn a share of the protocol fees by providing liquidity to these markets. Increased LP collateral & liquidity will support higher open interest and trading volumes.

Liquidity Providers: Earn Fees and Support Market Growth

Synthetix Perps relies on liquidity providers to support perps liquidity. By providing liquidity to the new Spartan Council Pool, LPs can earn a portion of the trading fees generated by the protocol. Additionally, Synthetix currently offers liquidity incentives in the form of SNX/USDC rewards for LPs in addition to the regular perps trading fees.

More liquidity in these markets will enable higher open interest, increased trading volumes, and the potential for additional markets to be launched on Synthetix Perps.

Risk Warning: Providing liquidity is not risk-free. LPs may experience losses if market skew is imbalanced. Other risks include smart contract vulnerabilities and collateral (USDC) depegging. As always, do your own research and only deposit what you can afford to lose.

For more information on the risks and mechanics of providing liquidity on Synthetix Perps, please consult the Synthetix Docs.

Any Questions?

Join the Synthetix Discord for any questions or concerns