Synthetix Mainnet

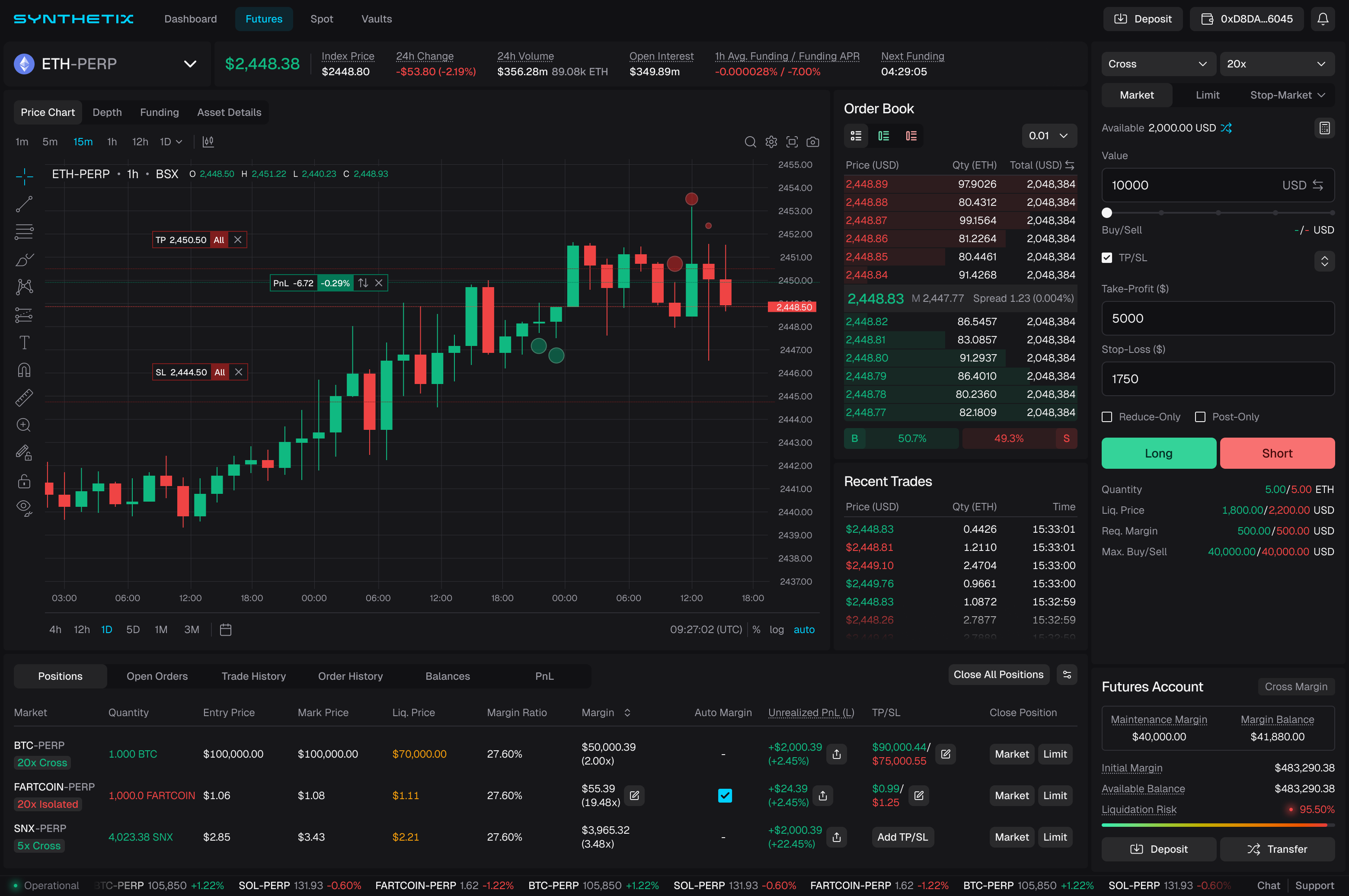

Synthetix is returning to Ethereum mainnet to launch a perps exchange

Launching the first perps DEX on Ethereum Mainnet

In 2019, Synthetix led the move to Optimism, as Ethereum wasn't scaling fast enough. While we solved scaling, what many of us underestimated was the impact of liquidity fragmentation from the proliferation of Layer 2 blockchains. The L2-centric roadmap diluted attention, activity and capital away from Ethereum mainnet and ETH the asset.

This enabled more chains like Solana to capture mindshare.

Finally the tide is turning. Validators, core developers, and even Vitalik are rallying the community to refocus on Mainnet.

The missing component is DeFi projects coming back to mainnet to leverage the growing block space capacity, to deliver unique products that are optimized for security and stability of Ethereum.

Mainnet is where institutions are looking, where ETF flows land, and is the home of RWAs and stablecoins. Ethereum Mainnet holds over half of all DeFi value, more than seven times that of any L2. Despite this value dominance, very few novel protocols have launched on mainnet since L2s became prevalent, with the exception of EigenLayer and Ethena.

Synthetix is coming home again. This means getting rid of all the technical debt that’s accumulated over the last 4 years, including ceasing all operations on L2s, redesigning staking (done), closing legacy pools, etc.

Synthetix has been battle-tested in DeFi since 2017, pioneering synthetic assets, liquidity incentives and yield farming and decentralized stablecoins. After years of championing and focusing product development on major L2s, we’ve seen and felt their limitations. Synthetix is returning to its Ethereum Mainnet roots, where DeFi was born, to launch a perps exchange. Something that no one has tried since perpetuals became the dominant financial product in crypto.

Competing with centralised exchanges

As recently as last year, Synthetix prioritized onchain decentralization above all else, even user experience. This uncompromising idealism hampered our ability to build elegant products. We were building for an ideologically aligned audience, but unable to scale past early adopters, let alone a wider crypto audience. We chased ideological purity, while users chased speed and simplicity.

We’ve learned the hard way that user experience is non-negotiable. No degree of decentralization, either real or perceived, can overcome clunky interfaces or poor performance. If DeFi feels clunky, users will stick with familiar centralized platforms.

To attract the next wave of capital and challenge incumbents, we must optimize for user experience, while remaining non-custodial, so we don’t become CeFi.

Let’s be honest: everyone in DeFi is competing with centralized exchanges.

Infinex has proven it is possible to deliver onchain, non custodial products with exceptional user experience.

Our job now is to make Mainnet trading so intuitive that users forget it’s onchain, meeting them where they are, not where we wish they were. Fortunately, Synthetix has a long history of solving difficult onchain challenges.

Increasing chaininess

Synthetix has learned that in order to win we need to own the customer experience, offer an orderbook instead of an AMM, and deploy on Ethereum mainnet instead of L2s.

Despite years of trying to make onchain AMMs work for perps, orderbooks offer better liquidity and trader experience. While orderbooks can’t currently be run on mainnet, Ethereum is the best place to custody, and settle, without the bridge risks or liquidity fragmentation.

In order to return to mainnet, we are using a different architecture to anything before, with offchain order matching, and batch settlement onchain:

- L1 Custody and Settlement: Users don’t want to bridge large amounts to L2, so we are using L1. User funds are custodied on L1, and trades settle directly to L1. Trader margin is managed by the offchain orderbook (for now), but onchain withdrawals are permissionless.

- Offchain Matching Engine: Institutional-grade exchanges demand high-throughput, low-latency, fault-tolerant matching engines. Neither L2s or Solana, nevermind Ethereum, have sufficient throughput to run a matching engine onchain. Our offchain engine delivers the performance professional and discerning traders expect.

As Ethereum scales, more functionality will migrate onchain, and is the primary vector of decentralization.

“The Relaunch”

This is the biggest Synthetix launch in history, and we’re putting up [redacted] SNX tokens towards launch incentives. SNX tokens will be earned from points, which start accruing in Phase 0 of the campaign, beginning with sUSD and sUSDe predeposit vaults.

500 early access invite codes will be issued to sUSD and sUSDe pre-depositors, 420 pool depositors and key partners. These will grant exclusive access to early testnet and mainnet deployments, as well as several gated trading competitions - each of which will have a large prize pool including SNX, stables and [redacted].

Points will be earned through pre-deposits, trading performance on testnet and mainnet, referrals and other activities in the lead up to the full deployment of Synthetix perps on Ethereum Mainnet.

Phase 0 will start this month, with sUSD and sUSDe deposit contracts live before ETH CC.

Mainnet Perp Summer.

Restoring the role of SNX and sUSD

The SNX token is reclaiming its place at the heart of Synthetix as a source of yield, liquidity, and governance alignment. We’ve overhauled SNX staking to be intuitive: stake SNX, earn protocol fees. No PhD required. The staking offering is simple, with no need for hedging, active debt management, or complex onboarding.

Synthetix has the 3rd longest living stablecoin, sUSD. While we were inadvertently removing the utility of our own stablecoin by launching v3, other protocols had seen the opportunity and were launching their own stablecoins. We have seen the error of our ways, and are restoring the utility of sUSD.

Stakers no longer mint sUSD, that role now sits with the Treasury Market, which dynamically mints, burns and deploys sUSD to maintain the peg and fuel trading liquidity in the orderbook. sUSD will be the deposit asset for AMMs to market-make on the exchange, generating yield from trading activity, from sharing fees and from liquidations.

Synthetix has been a DeFi pioneer since its inception. With >50% of SNX now staked, Treasury-funded buybacks, and a Mainnet launch on the horizon, SNX is poised for a renewed role in DeFi.

Conclusion

The great irony of the L2 scaling roadmap is that it has made space for innovation and DeFi to return to L1, where it all began. Attention is rightfully returning to Ethereum Mainnet and the protocols that add value to the chain that started it all. Synthetix is delivering a critical missing piece: a high-performance perp exchange, cementing Ethereum’s role as the home of global finance.

Join the Community

Follow Synthetix as we speedrun to mainnet.

Join the conversation: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Follow on X: x.com/synthetix