Synthetix Exchange Launches with Multi-Collateral Perps on Base

The Synthetix Reboot is accelerating with the re-launch of Synthetix Exchange, the release of Multi-Collateral Perps on Base, a new website, and the upcoming launch of Synthetix Leveraged Tokens. Base Multi-Collateral Perps on the new Synthetix Exchange enables Perps traders to use a variety of new collateral types and maintain their exposure to favorites like BTC and ETH.

Preparing for this major release, we kicked off the Decembrrrr Base LP Incentives, a four-week promotion for Base LPs with 80,000 SNX and 100,000 USDC rewards running from December 10th through January 7th. We’ve also increased the trading fee distribution on V3 by 50%, further boosting LP incentives with SCCP-373. Early users of both Synthetix Exchange and the upcoming Synthetix Leverage Tokens can look forward to new incentive programs planned for January.

Synthetix Exchange is Back

After two successful acquisitions, Synthetix now has two new trading products for users, a bold departure from the previous strategy of providing back-end liquidity and infrastructure to derivatives platforms. Less than a month ago, Synthetix acquired their ecosystem-leading Perps DEX Kwenta after a successful vote by both DAOs.

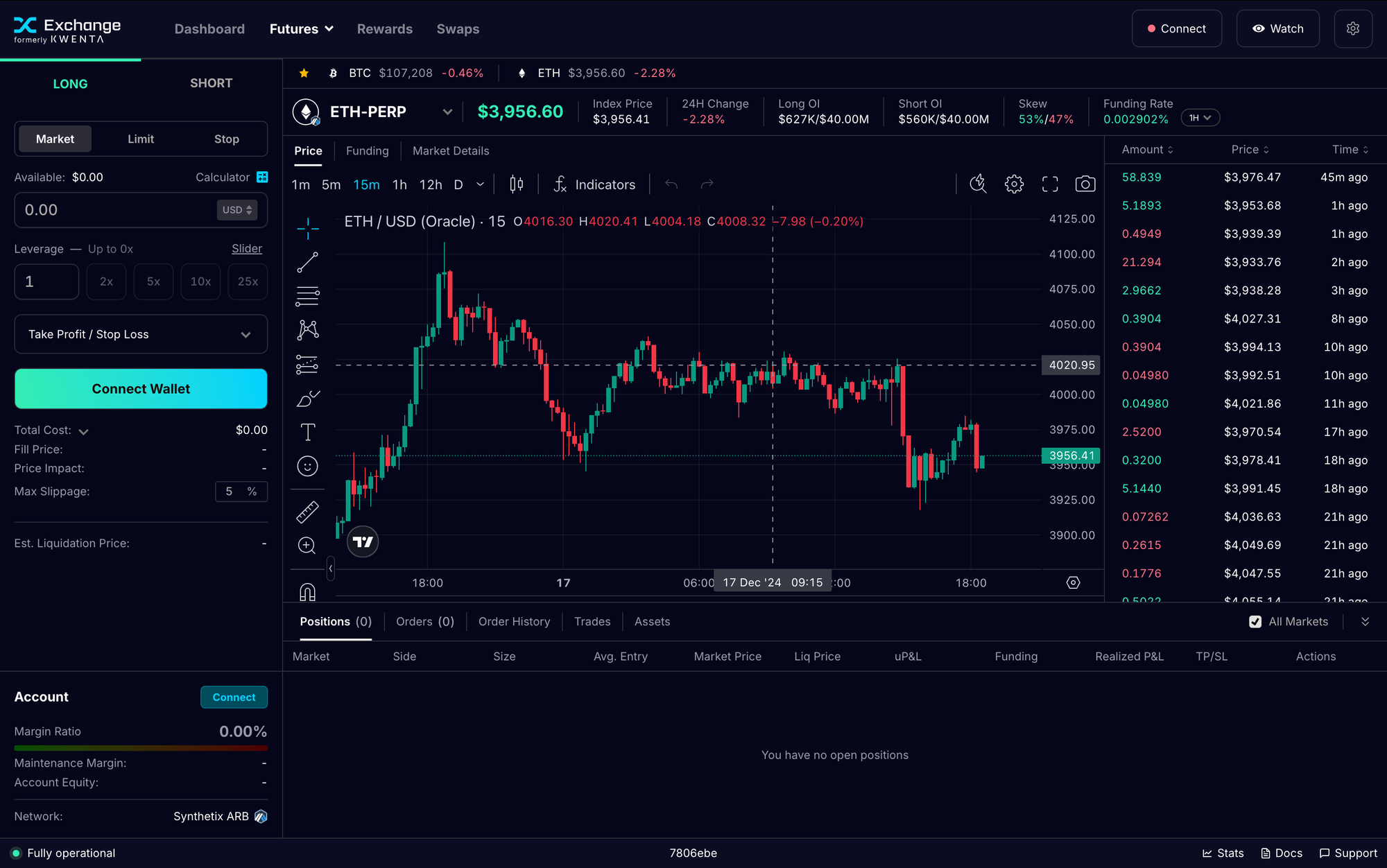

Today marks the re-launch of Synthetix Exchange with an updated UI and, most importantly, Multi-Collateral Perps on the Base network. While Synthetix will continue to support and welcome builders of derivatives products and exchanges, Synthetix Exchange will become one of our new flagship products alongside Synthetix Leverage Tokens, providing a world-class trading experience with low fees and deep liquidity.

New Collaterals for Base Perps

Since our initial Base deployment with support for only USDC as margin, we’ve listened to the community’s demand for greater asset flexibility. With this launch, Perps V3 on Base now supports multiple new collateral types featuring:

cbBTC

Coinbase’s wrapped Bitcoin, cbBTC, is backed 1:1 by BTC and held in custody by Coinbase, which has a 10+ year record of securely custodying billions in Bitcoin for institutions and customers. Utilized across dozens of DeFi platforms, cbBTC gives Bitcoin holders more flexibility.

Coinbase customers in select geos can use the send & receive feature to move their BTC on and offchain seamlessly. When users send their BTC from Coinbase to Base, Solana, or Ethereum, it will automatically be converted 1:1 to cbBTC. When users receive cbBTC in their Coinbase accounts, it will be converted 1:1 from cbBTC to BTC.

cbETH

Coinbase’s liquid staking version of ETH, cbETH, is a token that represents staked ETH. It’s designed to be used throughout the onchain ecosystem, enabling participation in dozens of DeFi integrations without lockups.

Staked ETH can be wrapped into cbETH in just a few steps and with zero fees on the Coinbase platform, as well as unwrapped at any time.

wstETH

Lido’s wrapped staked ETH (wstETH) is by far the most popular liquid staking token for Ethereum, with a staggering 72% market share and market capitalization of over $25 billion according to Dune. Lido’s wstETH boasts over 100+ integrations with wide adoption across DeFi protocols and wallets. Non-custodial and battle-tested, wstETH represents staked ETH in a decentralized network of validators.

wETH

Last but not least, wrapped ETH (wETH) is Ethereum that can be used in a variety of DeFi applications on the Base chain. Backed 1:1 with ETH, it can be exchanged for ETH at any time and is equal in value. While liquid staking versions of ETH may be preferred by some users, there are many who prefer ETH without additional staking or re-staking smart-contract risk to use in DeFi applications.

For more details on these new collateral types, see SCCP-357.

Multi-Collateral Benefits

This collateral expansion lets traders maintain direct exposure to popular crypto assets like BTC and staked ETH without requiring stablecoin collateral for Perps trading. This gives them more control over margin positions and easier access to hedging, diversification, and growth. By offering diverse collateral options, the market opens up to those who prefer limited stablecoin exposure, enabling traders to use their crypto holdings as collateral rather than stablecoins.

Unlocking New Strategies

Multi-collateral support is also designed to give traders, liquidity providers, and integrators the flexibility to employ more advanced strategies, such as delta-neutral positioning and varied risk exposures. We are excited to see this expanded collateral functionality unlock even more potential for growth within the Synthetix ecosystem on Base.

Get started with Multi-Collateral Perps on Base

With the doors now open for Multi-Collateral Perps on Base, it’s the perfect time to explore this new way to trade. Visit Synthetix Exchange to get started today, and be sure to follow the SNX Exchange Twitter for all related updates, including details on the upcoming trading competition!