SNXweave Weekly Recap 65

November 16, 2022

The following post contains a recap of news, projects, and important updates from the Spartan Council and Core Contributors, as well as the Grants Council and Ambassador Council from last week.

Spartan Council and SIP updates

Present at the November 10, 2022 Spartan Council Weekly Project Sync:

Spartan Council: Afif, Burt, dsacks, Ethernaut, ksett, nana, TerraBellus

Core Contributors: Ana, Cavalier, Darius, joey, noah, Regina, Steve

On the V2X side of things, SIP-288 should be wrapped up this week, we’re just waiting on 1inch to finish integrating on their side. SIP-299 is also coming along, as it’s currently in audit for a pre-review.

Right now, V3 work is focused on spot markets, R&D on scalability and cross-chain liquidity, and the rewards manager. Then the migration plan is the last main thing that the Core Contributors (CCs) want to make sure everyone is on the same page about.

As for Perps V2, it should be going to testnet this week with all of the audit feedback implemented (the auditors mainly said they wanted to have it more holistically). David just got through the premium discount stuff, so Afif said the next step is working through some of the downstream side effects of premium discount. And in exciting news, Anton is going to be helping out with Perps V2! Since he was the original architect on the Perps V1 contracts and understands them very well, he’s going to be code-reviewing and helping out on mechanism stuff and anywhere else that he can.

Staking V2 is also expected to go live hopefully this week, as it was released internally last week amongst the CCs and some of the DAOs for a first-round review.

Towards the end of the call last week, the Spartan Council discussed the c-ratio, after nana brought up wanting to lower it. Burt pointed out that Gauntlet recently said they have some updated data, and that it would be a good idea to see what their models are saying. Ksett and Afif said they wouldn’t want to lower it at the moment, but are open to seeing Guantlet’s analysis. Terra and Ale also stressed wanting to see the data before putting it to a vote.

Lastly, Terra asked if anybody had observations on how the system has held up during the period of volatility. Afif said everything seemed to be functioning smoothly, and that there weren’t a significant number of forced liquidations. He added that the perps markets also held up really well, with the circuit breaker kicking in a few times on SOL because there were huge dislocations throughout the market. And, in even better news, the perps markets have actually been net positive for the protocol through this period of volatility.

There were also several SIP presentations last week, all for V3, so let’s briefly review them:

SIP-304 proposes a liquidation mechanism for V3 where liquidated positions have their collateral and debt distributed among other participants in their vault. And if an entire vault is liquidated, all (or part) of its collateral is seized by the system and sold to repay debt.

Basically, this proposes 2 types of liquidations:

- You’ll be able to liquidate a position

- And you can liquidate an entire vault in certain circumstances

Terra asked if there is any incentive to set up a bot that pulls your liquidity prior to another vault participant being liquidated. Afif said a liquidation event is going to be kept neutral to the user so there’s no incentive to run away from it or step in to try and steal it.

Next, SIP-305 proposes a system for providing rewards in V3. The idea is to create an abstract interface that allows all sorts of rewards to be handled and distributed across vaults and specific pools. Basically, there will be multiple pools, where each pool has a vault for each collateral type, and each vault has a rewards manager. Noah explained that the pool owner is allowed to attach a rewards distributor to a rewards manager, adding that the rewards manager is sort of an abstraction of the staking rewards contract, where it’s able to see the pro rata debt distribution across all of the stakers participating in the vault.

SIP-308 for market-provided collateral was also presented, which proposes adding functionality that allows markets to increase their credit in the system by depositing collateral directly in the protocol. Noah said this SIP is basically an abstraction that allows the creation of wrappers and spot markets in V3. Fundamentally, this allows a market to be able to deposit any of the accepted collateral types in the protocol itself, then the collateral is credited to its balance sheet at whatever the value is according to the protocol.

Lastly, SIP-309 proposes adding functionality that allows markets to prevent withdrawal of delegated collateral. This is basically just proposing an additional piece to the interface where a market can say how much collateral is locked. And when it’s locked, the pools that are backing the market can’t reduce the amount of liquidity that is being provided to the market below a dollar denominated value being specified by it. Afif simplified this by saying it’s basically a way to lock collateral to make sure it stays attached to the debt.

Grants Council

Present at the November 10, 2022 Grants Council meeting:

Grants Team: ALEXANDER, CT, cyberduck, JVK, Max

In Grants Council updates, Max and CT sat down with Jake from dHEDGE to talk about the grant that the Council awarded them and clarify some of the expectations. Max was able to give input on how to improve their documentation as well.

Max also had a chat with bigkey about the Stats page, who asked if Max could review his code. Since Bigkey is busy building a dune analytics dashboard with all of the data for the stats page, Max has been working with him on which data points to add.

The Council also discussed the NFT lore, for which they read several different story paths. They have chosen one path to pursue and the author has been given feedback about which to expand on, and other details to include in the lore.

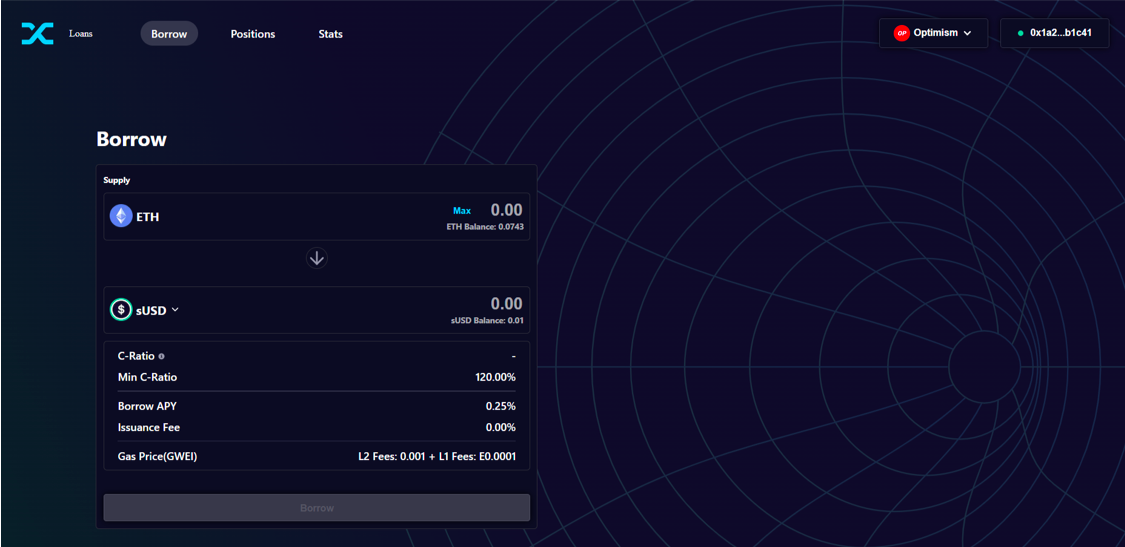

Lastly, in case you missed it, the new Loans UI went live last week!

You can now use this dedicated site to manage your sUSD or sETH loans. New features include viewing your liquidation price and previewing your c-ratio when managing your loan. There is currently a google doc open in the grants-announcements channel for any feedback that the community has related to the new Loans UI, so be sure to share your experience there and help the Grants Council improve this for the future!

Ambassador Council

Present at the November 10, 2022 Ambassador Council meeting:

Ambassadors: GUNNBOATs, Kevin, mastermojo, Matt, MiLLiE

In Ambassador updates, the team hosted another Spartan Space last week — this time with Synthetix Core Contributors Afif, db, and Noah to talk about V3! The three CCs have all been at Synthetix for over a year now, and have been deeply involved in V3 for several months.

Afif gave us some baseline knowledge of how V2X works, then some big picture goals of Synthetix V3. He said the common theme for V3 is maximized generalizability and modular product design. The biggest mechanism change is the idea of differentiated debt pools, which has a lot of downstream properties and allows V3 to:

- Have markets that are purely permissionless

- Invite more experimentation with its simpler, cleaner system for developers

- Be more adaptable to different ways to scale the stablecoin

- Offer multi-collateral staking

“Just to summarize all that, Synthetix V3 really sets Synthetix up to be a fully decentralized liquidity provisioning protocol that any protocol can tap into to spin up a market or asset that they want to bring on chain with an oracle.” -Matt

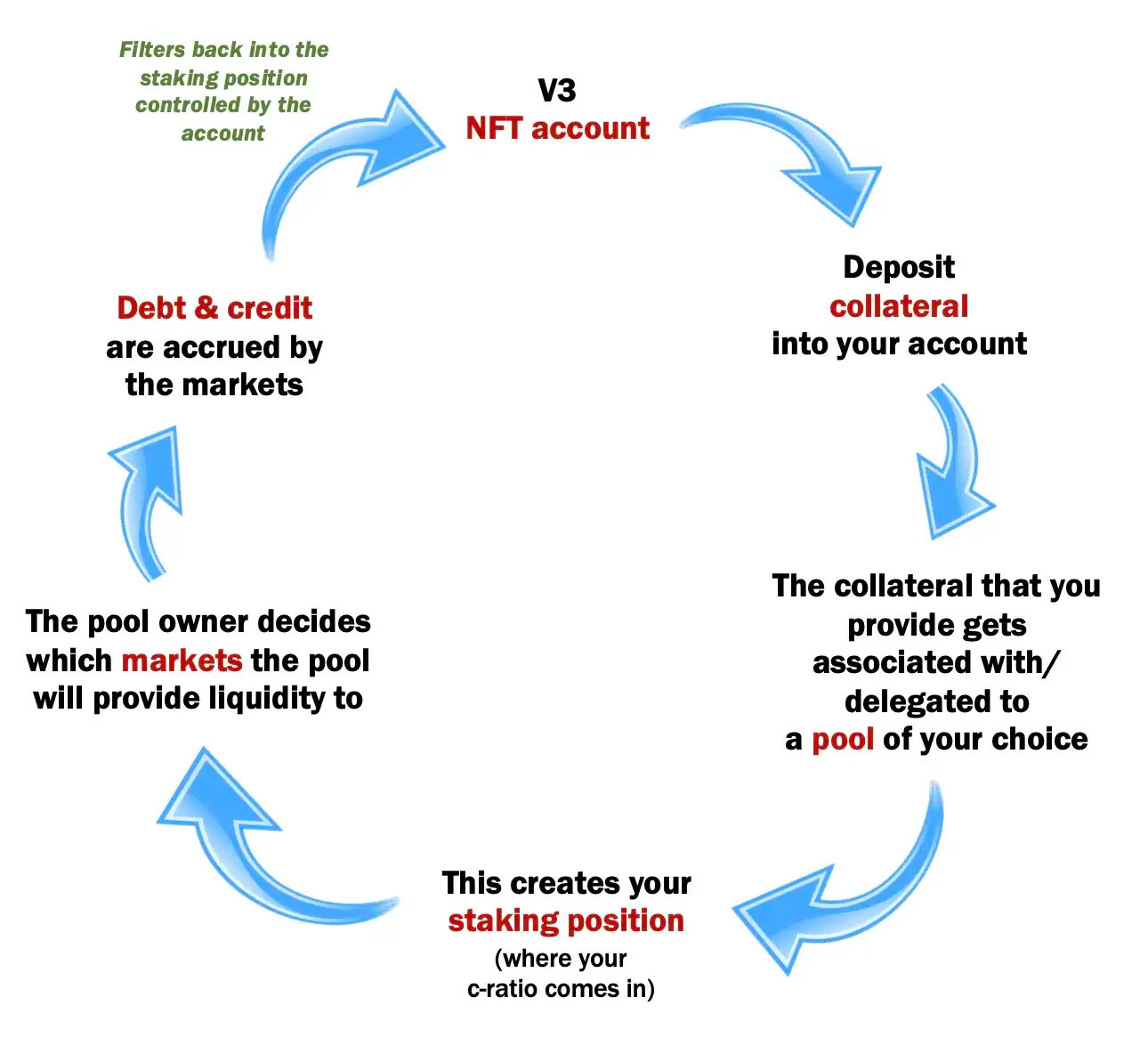

Noah also gave a pretty in-depth review of all of the V3 terms that we’ve been hearing a lot recently (such as markets, pools, assets, staking position, debt, etc.). To simply everything he said, we made this diagram to help visualize how all these Synthetix V3 terms interact.

Right now with V2, your staking position is associated with a wallet. So one of the big upsides of having an NFT account for V3 is you can move it around between wallets, open up staking positions in relation to that account, and you can even grant permissions to different wallets to do things with your account.

V2 currently has a single pool that is controlled by governance. But in V3, your account can have many different relationships with different staking positions/pools, and the pool owner is able to decide which markets the pool is providing liquidity to. Then within a pool, there’s a vault for each of the acceptable collateral types, and each of the vaults can have rewards distributors attached to them so there can be different incentives structures.

Basically, you can create a staking position by depositing and subsequently delegating collateral to a pool of your choosing. Your staking position will then start to accumulate debt and credit from the markets that are backed by that pool. That credit bubbles up through the pools, and then into various markets, which use that liquidity and credit capacity to provide it to stakers who can then mint their own different assets. And any debt or credit accrued by that market can filter back down through the pools and into the staking positions controlled by the account.

During the Space, the Ambassadors also talked to the guests about major V3 features that will basically be milestones on the way to the big picture goals. They went into detail about features such as permissionless market and asset creation, differentiated debt pools, improved staking, synth teleportation, scaling sUSD, and overall architecture. So be sure to check out the recording to hear more about V3 and to get even more excited about its release!

And lastly…the Ambassador Key Performance Indicators (KPIs) for October are in! As a reminder, the Council uses these various indicators to measure their level of outreach, and at the end of each month we report them to maintain accountability. Over the course of October the Ambassadors were successful in hosting Spartan Spaces, accumulating delegated tokens, participating in governance forums, and integrating with other protocols.

Ambassador KPIs for October 2022:

Spartan Spaces:

- Spartan Space — Velodrome October 6th (55 listeners)

- Beefy x Velodrome (hosted by Beefy)

- Spartan Space — Perps V2 with Afif October 19th (92 listeners)

Governance Activity:

Governance Forum Activity:

Integrations:

- Beefy Boosted sUSD vault

- Hop Protocol SNX integration

- Granary Finance sUSD integration

- Granary Finance SNX integration

- Sonne Finance SNX integration

Podcast now also on YOUTUBE

SNXweave Anchor Podcast: https://anchor.fm/snxweave

Follow us on Twitter! @snx_weave

SIP/SCCP status tracker:

SIP-288: 1inch Direct integration, Status: approved

SIP-299: Minor upgrades to V2X to support V3 migration, Status: approved

SIP-304: Liquidations (V3), Status: draft

SIP-305: Rewards (V3), Status: draft

SIP-308: Market-provided Collateral (V3), Status: draft

SIP-309: Market-locked Collateral (V3), Status: draft