SNXweave Weekly Recap 59

October 5, 2022

The following post contains a recap of news, projects, and important updates from the Spartan Council and Core Contributors, as well as the Grants Council and Ambassador Council from last week.

🚨Election Results!🚨

First and foremost — let’s talk election results!

· Your Spartan Council members for the upcoming epoch will be Adam, Afif, Burt Rock, Danny, Ethernaut (Ale), ksett, nana, and TerraBellus

· Serving the community on the Treasury Council this epoch will be artsychoke, elliptic-crv, Jordan, and Spartan Glory

· Our upcoming Grants Council members will be ALEXANDER, CT, cyberduck, JVK, and Max

· And lastly, your Ambassadors for the coming epoch will be GUNBOATs, Kevin, mastermojo, Matt, and MiLLiE

Thank you to all who ran, voted, and participated in governance this epoch, and congratulations to our newly elected Council members!

Spartan Council and SIP updates

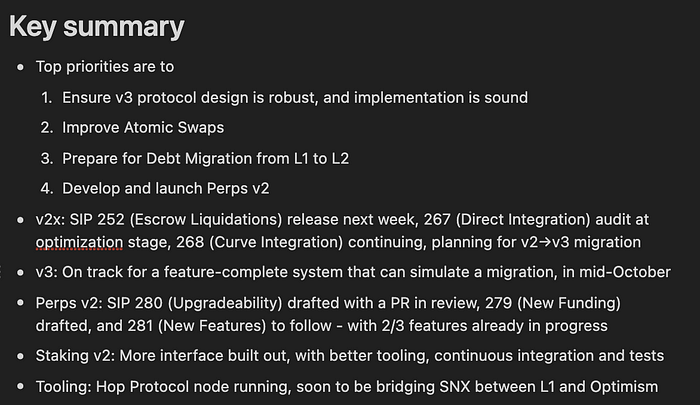

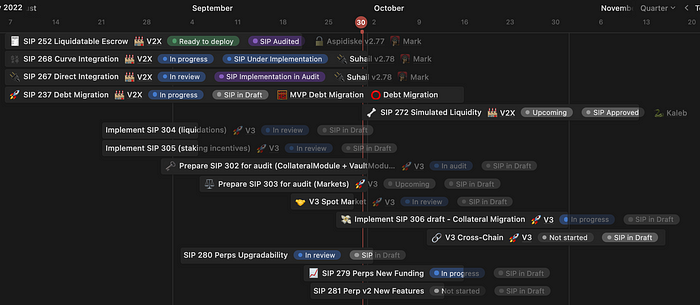

Now onto our regular news updates: the Spartan Council and CCs did not hold a meeting last week, but they did share a couple of graphics to give a brief status update. Check them out:

Grants Council

Present at the September 29, 2022 Grants Council meeting:

Grants Team: CT, cyberduck, JVK, Mike

In Grants Council updates, Mike has been working with Cryus from dHEDGE and they have a rough outline for the dHEDGE Docs Project (for which Mike provided sample documentation).

All of Joey’s concerns about the Stats page have been addressed and the project is in its final stages of release.

For the SIP submission site, the SIP/SCCP number fields now automatically populate based on the next available number, which is very handy. It can still be manually changed, however. The team is also working on bringing more visibility to pr.synthetix.io by adding links to it from different landing pages (such as governance, staking, tools, etc).

Lastly, JVK has been working on a document to guide the dev who is working on the mint for the NFT project. This doc includes minting probability estimates for different attributes such as family, tribe, gender, etc. He presented this info last week to the Grants Council for feedback before finalizing it.

Ambassador Council

Present at the September 28, 2022 Ambassador Council meeting:

Ambassadors: mastermojo, Matt, MiLLiE

In Ambassador Council updates, the team hosted another Spartan Space last week, this time with dHEDGE where they spoke with them about their most recent Lyra integration, and some other new developments. During the call, we got to hear from Ermin and Jake. Both are Core Contributors at dHEDGE with focuses on smart contracts, but Ermin also helps with business development and Jake with engineering.

As a brief background, dHEDGE is a decentralized asset management platform that originally launched on ETH Mainnet and is currently also deployed on Polygon and Optimism.

Toros uses dHEDGE to run automated vaults, but SNX stakers might be most familiar with the dSNX vault that can be used to hedge staker debt — this vault takes on the same exposure as the debt pool algorithmically. The team has recently put a pool of stablecoins to work with the goal of dSNX outperforming the debt pool. Ermin explained that the idea is: if you have to sell in order to cover your debt position, you’ll actually end up with a little extra money than just a strict delta neutral strategy. The team is also working on integrating a benchmark tool on the frontend so that users can see how their dSNX is performing against the debt pool.

The Ambassadors asked the guests how Toros finance came to be, and they explained how they noticed a lot of demand for these types of automated strategies. The main idea for Toros was giving the users the choice of how much exposure to volatility they want to take on. Ermin said they decided to call them dynamic vaults because the strategy can change depending on market conditions, but the exposure remains the same.

They also gave an overview of the Blue Volcano release, saying it’s a major integration in partnership with Lyra with the goal of bringing options to dHEDGE. Jake thinks this will open up a lot of opportunity for managers to demonstrate skills and performance using options as part of a broader asset allocation.

When asked if there are plans for integrating LP in the future, Jake said it’s not in the roadmap just yet. He added that they try to only offer products where users have instant liquidity, and the problem with LPing is there is typically a lockup period. dHEDGE is however open source, so the team is happy to engage with anyone in the community who would like to integrate their contracts and offer additional functionality.

For the Optimism governance allocation, the guests explained that their request was to help incentivize pool activity and liquidity mining. Incentives will go towards a DHT/OP pool on velodrome. The proposal actually passed last week, so they now have 350k OP to distribute. They said they don’t have a detailed distribution plan yet, but they know the OP will be distributed to whitelisted pools. The dSNX pool would most likely qualify, making it a “lucrative product for a period of time.” The whitelist, however, needs to be approved by governance.

Lastly, when asked if there is another trading competition on the horizon, Jake said it’s absolutely on the radar. He added that last time, there were only a few synths available and not a lot of room for managers to run sophisticated strategies.