SNXweave Weekly Recap 167

February 5, 2025

The following post contains a recap of news, projects, and important updates from the Spartan Council and Core Contributors from last week.

👉TLDR

- SIP-420: Protocol Owned SNAX — This is in its final audit stage. See below for a refresher on the contents of this proposal.

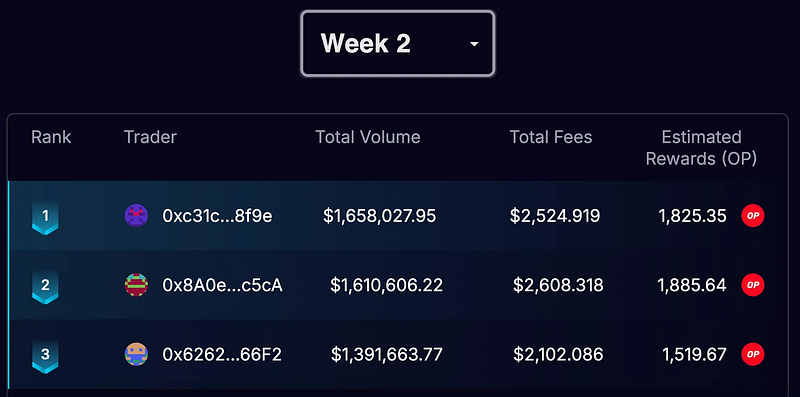

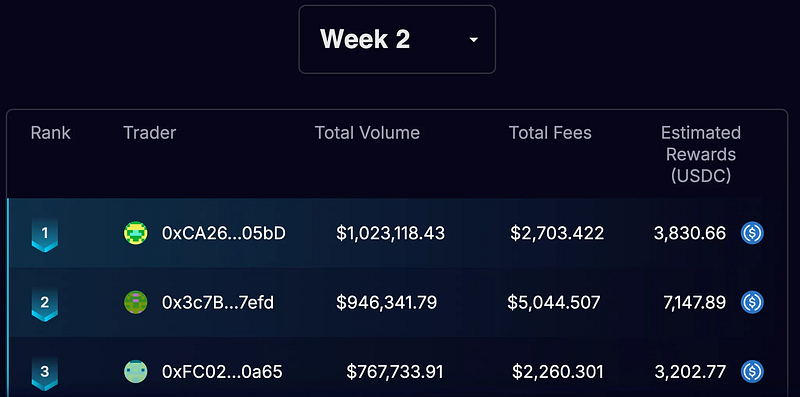

- Synthetix Leveraged Token Rally rewards program: Week 3 of 5 has just begun, with another 15,000 $OP and 30,000 $USDC up for grabs. See last week’s leaderboard below.

- Discord alpha about free $OP bets from Overtime: Synthetix struck a deal (thanks Burt!) last week with Overtime Markets so that the first 250 addresses to trade on Synthetix Leverage for the rest of the week (ended February 3), would earn a free 10 $OP bet on Overtime.

- Stop Loss and Take Profit order types have been added to Synthetix Exchange

- 1-click trading and account abstraction is in final testing stages

- Arbitrum deprecation is near completion

- Fenway updates: Synthetix is transitioning from being solely a liquidity service to taking charge of the product development (frontend UX developments are off the charts, Synthetix vaults as a new product is bringing many positive changes).

- V4 is coming: Synthetix V4 will deliver a trading experience that is competitive with other on-chain DEX’s without making some of the centralization tradeoffs that competitors have had to make. Trading and LP activity on V3 on Base will continue. See more details below.

- Synthetix Exchange new tools and docs: Now there is an easier way to modify your positions with limit orders on Optimism. The new pencil icons on Synthetix Exchange allow modification through market, limit, and stop orders.

- New Perps markets are live: $VELO, by Velodrome, and $VVV, by Venice.

- Rewards for sUSD depositors on Infinex still ongoing: Rewards were just DOUBLED to 10,000 OP and 10,000 SNX being distributed weekly. See results from last week’s Patron NFT drawing below.

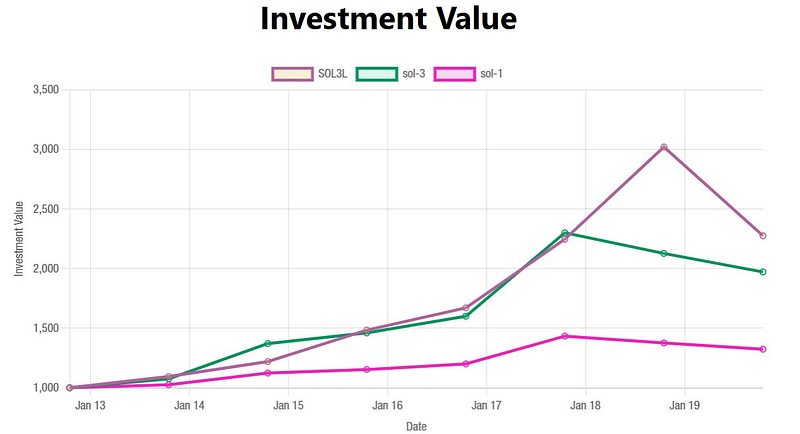

- Synthetix performance comparison thread on X: 🥇SOLBULL 3X Leveraged Tokens vs. 🥈SOL Perps vs. 🥉SOL Spot. See full results of performance comparison below.

Spartan Council and SIP updates

During last week’s sync the Council discussed some product updates, including SIP-420 which is in its final audit stage. Big things are cooking with this implementation and we’ll be keeping up with its progression, so stay tuned for updates. But just as a refresher:

- This SIP was proposed by Kain to introduce a delegated staking system where SNX holders can contribute their existing debt positions to a protocol-owned pool, allowing the protocol to manage debt and generate yield, while offering stakers better incentives.

- This is supposed to make staking much easier and more accessible by offering lower risks, higher returns, and long-term rewards, like liquidity incentives and treasury collateral redistribution (it was proposed that 10 million SNX from the treasury be used as staking incentives).

- Burt Rock also posted a great thread about this SIP on X, so be sure to check that out as well!

Next up, as we mentioned last week, the Synthetix Leveraged Token Rally rewards program is ongoing and is currently in its final swing. We have just entered week 3 of 5, so if you missed out on the last couple of weeks it’s not too late to join! This week another 15,000 $OP and 30,000 $USDC are up for grabs — just mint Leveraged Tokens at http://leverage.synthetix.io and climb the leaderboard. Here’s a look at last week’s top traders and the rewards they took home:

Weekly rewards accumulate throughout the event, and participants can claim them in their dashboard after Week 5. Don’t miss out!

Speaking of missing out, did you catch the Discord alpha about free $OP bets from Overtime?? Synthetix struck a deal last week with Overtime Markets so that the first 250 addresses to trade on Synthetix Leverage for the rest of the week (up until this past Monday morning), would earn a free 10 $OP bet on Overtime. Shout out to our friends at Overtime! Just in time for the Super Bowl in the states.

But getting back to last week’s Spartan Council sync, the team also discussed how Stop Loss and Take Profit order types have been added to Synthetix Exchange, and 1-click trading and account abstraction is in final testing stages. The Arbitrum deprecation is also near completion (all LPs and traders are being advised to withdraw and exit the system ahead of anticipated liquidation ratio increases to accelerate the wind down).

Fenway also brought up how Synthetix is at an interesting point in the protocol’s development, as the core mission is changing from being solely a liquidity service to taking charge of the product development. The frontend (Synthetix Exchange) has seen a lot of UX improvements, and there are more to come over the next couple of months. He added that Synthetix vaults as a new product will enable users to execute funding rate arbitrage and basis trade capture strategies, and the plan is to build user friendly UIs for this product to make it more accessible for typical traders.

Also, Fenway announced that incentives for users holding sUSD on Infinex would be doubling last week — the APY increasing from 25% to 50%.

AND…V4 is coming! Synthetix V4 will deliver a trading experience that is competitive with other on-chain DEX’s without making some of the centralization tradeoffs that some competitors have had to make. V4 will be deployed on SNAX Chain, and SIP-420 will free up some liquidity to help get this going (via a reduced c-ratio) and support more OI right from the launch. Trading and LP activity on V3 on Base will continue, but expect more details about all of this in the coming weeks.

Next, the Synthetix Exchange team has been hard at work on some hot new tools and docs. They’ve listened to your feedback and have implemented an easier way to modify your positions with limit orders on Optimism. The new pencil icons on Synthetix Exchange allow modification through market, limit, and stop orders. You can scale in or out of trades easily, using market or conditional orders — all without depositing any additional margin.

Speaking of Synthetix Exchange, a couple of new Perps markets are now live: $VELO, by Velodrome, and $VVV, by Venice.

And don’t forget — Infinex sUSD depositor rewards are still happening! Rewards were actually just DOUBLED to 10,000 OP and 10,000 SNX being distributed weekly. Last week there were 334 users who deposited $1,000 or more sUSD and qualified for the week 2 random Patron NFT drawing — and the winner was Cyberdruid! But everyone is winning with these rewards. 😉

Lastly, Synthetix recently posted a thread on X that goes through a performance comparison of SOLBULL 3X Leveraged Tokens, SOL Perps, and SOL Spot. These 3 different ways to long SOL were backtested over a 7-day span (January 13 — January 20) to see which performed best and help users better compare trading options.

- 🥉Third place: SOL Spot, with a $1,000 spot buy of SOL being worth approximately $1,324 for a value increase of +32.4%.

- 🥈Second place: the 3x SOL Perp long with $1,000, finishing at $1,972 with a +97.2% value increase.

- 🥇First place: the SOLBULL 3x Leveraged Token, finishing at $2,276 with a +127.6% value increase.

Keep in mind, however, that this comparison does not account for Perps funding or account for fees (which can vary from platform to platform). But, with all fees being equal in this test, the Leveraged Token was the strongest performer over this time period as it automatically rebalances, taking unrealized PnL to increase the position while maintaining the leverage factor of 3x.