Nine New Synthetix Perps Markets are now live

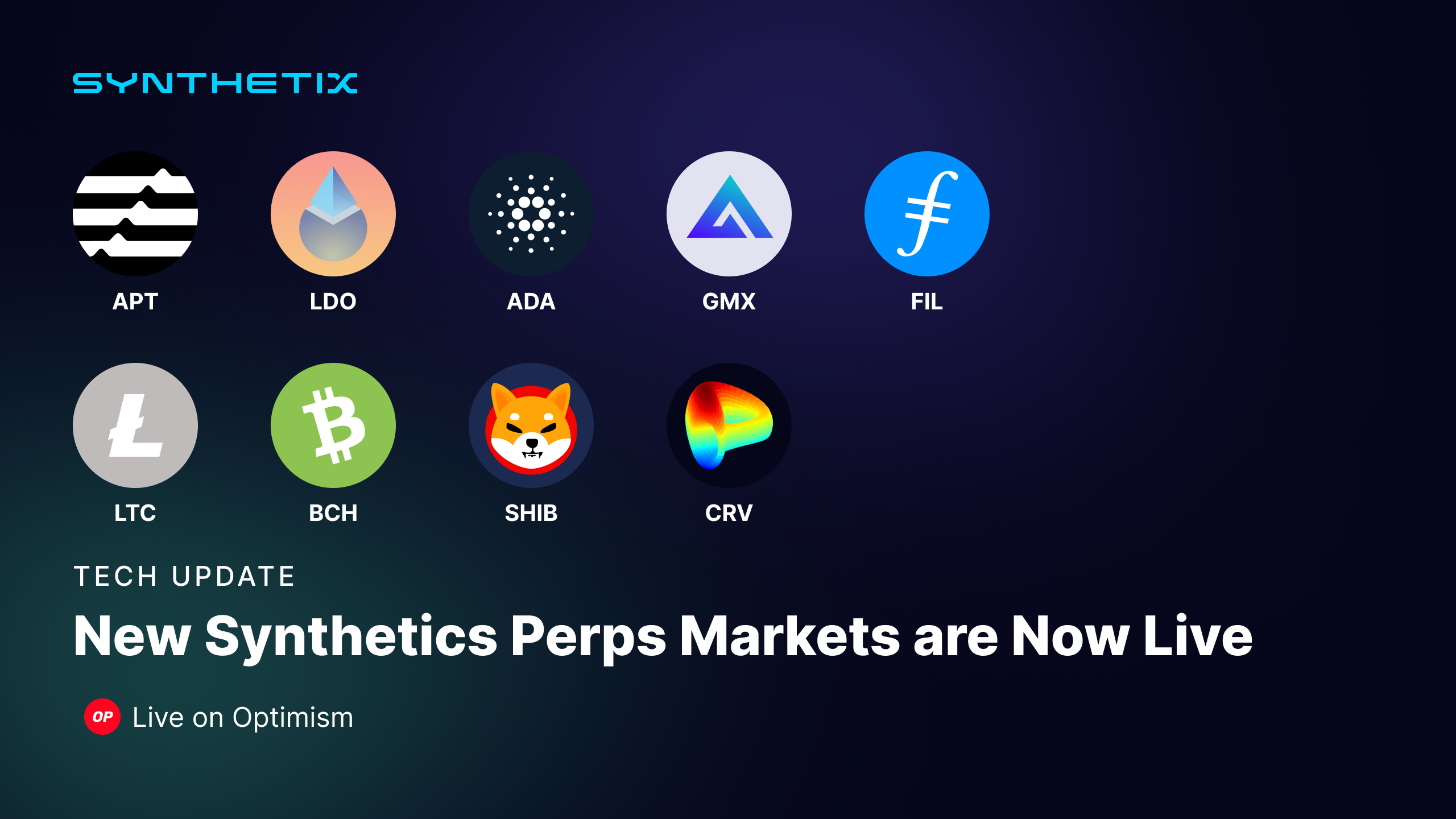

Synthetix is thrilled to announce the addition of nine new perpetual futures markets available for leverage trading on Synthetix Perps.

The full list of new perpetual markets includes APT, LDO, ADA, GMX, FIL, LTC, BCH, SHIB, and CRV. These markets were approved by SIP-298 and had initial configurable values set by SCCP-2000.

Trading Synthetix Perps

Synthetix Perps can be traded on front-ends that integrate with SNX liquidity and support perps trading: Kwenta, Polynomial, Decentrex, and dHEDGE.

Please note that Synthetix DAO does not provide any trading front-ends directly and instead relies on third-party user-facing protocols to serve traders. For more information on integrating with Synthetix Perps, please refer to the Synthetix Docs.

New Perpetual Futures MarketS

The addition of these new markets expands the number of assets available for leverage trading through Synthetix Perps. Prices will be set by the decentralized off-chain Pyth Network oracle, and fees may vary depending on the asset.

The latest configurable values, including fees, open interest, and more, can be found in SCCP-2000 .These are configurable governance values and can be changed at any time.

| Market | Offchain Make/TakeFees | MaxMarketValue | SkewScale |

|---|---|---|---|

| sLTC | 2/8 | 45,000 | 1,650,000 |

| sADA | 2/8 | 7,500,000 | 290,000,000 |

| sAPT | 2/10 | 125,000 | 8,100,000 |

| sFIL | 2/10 | 225,000 | 11,300,000 |

| sSHIB | 2/10 | 75,000,000,000 | 6,370,000,000,000 |

| sLDO | 2/10 | 200,000 | 19,000,000 |

| sBCH | 2/10 | 6,000 | 340,000 |

| sCRV | 2/10 | 727,000 | 50,000,000 |

| sGMX | 2/10 | 7,000 | 75,000 |

Listing New Synths

The process for adding new Synths to Synthetix is based on demand, liquidity, and volatility. All markets must be approved by Synthetix Governance through a SIP and/or a subsequent SCCP to configure variables. Additionally, data feeds from Pyth and Chainlink are necessary for any proposed assets to be considered for inclusion.