New Liquidation Mechanism

Governance Adjustable Variables

Target C-Ratio: 400%

Liquidation Ratio: 175%

Forced Liquidation Penalty: 75%

Self-Liquidation Penalty: 70%

Liquidation Delay: 8 hours

Within the next few hours (Saturday, May 14th, ~3:00-6:00AM UTC), Synthetix releases a new liquidation mechanism that completely overhauls the former system. This new mechanism will strengthen the protocol and ensure that cascading liquidations do not destabilize the Synthetix protocol.

Stakers need to be aware of the new mechanism as these are sweeping changes that will affect every staker.

Prior Liquidation Mechanism

First, users must understand the former system and why the change was needed.

The first liquidation SIP was proposed in SIP-15 back in August of 2019. The motivation at the time was to encourage minters to remain above the required collateral ratio and create strong economic incentives for stakers to restore their C-Ratio if they've been flagged to be liquidated.

The current liquidation mechanism is as follows: The liquidator needs sUSD to liquidate someone else. The liquidator repays the debt issued by the staker being liquidated with their sUSD, and then it is burned. The SNX collateral is bought at a discount and sent to the liquidator.

A Reason for Change

While this did work during standard market conditions, there were fears that during periods of flash crashes and other volatile market periods, cascading liquidations could've caused risks to the stability of the Synthetix Protocol.

Furthermore, there were specific circumstances, such as June 10th and 11th, 2021, where extreme fear spread among SNX holders because of the effects of potential cascading liquidation.

This happens when new accounts get flagged for liquidation, resulting in fear among token holders who take action by selling. This depression in price then causes more accounts to be flagged for liquidation, and the cycle continues. This could result in the system's catastrophic failure, leading to significant losses for synth holders.

Due to this potential failure, a new system has been implemented to secure the protocol further.

New Liquidation Mechanism

First off, a brief explanation of how the new liquidation mechanism will work:

Once a person's C-Ratio goes below the liquidation ratio and they are flagged, they will have 12 hours to raise their C-Ratio back to the target c-ratio. In this scenario, one of three things will happen:

- Your C-Ratio goes below the liquidation ratio and you are flagged, and you do not self liquidate.

- You will be liquidated and incur the forced liquidation penalty on your staked SNX, your SNX will be used to payoff your debt, you will be left with what is leftover; all penalty SNX will be distributed to other stakers.

- Your C-Ratio goes below the target c-ratio and you are flagged, your liquidated SNX will be used to payoff your debt, you will be left with what is leftover, and you self liquidate.

- You will be liquidated and will the self liquidation penalty on your staked SNX; all penalty SNX will be distributed to other stakers.

- Your C-Ratio is increased above the target c-ratio after being flagged b/c you burned sUSD or minted new debt

- Nothing will happen; you will not be liquidated.

NOTE: Your escrowed SNX cannot be liquidated; please consider this when liquidating.

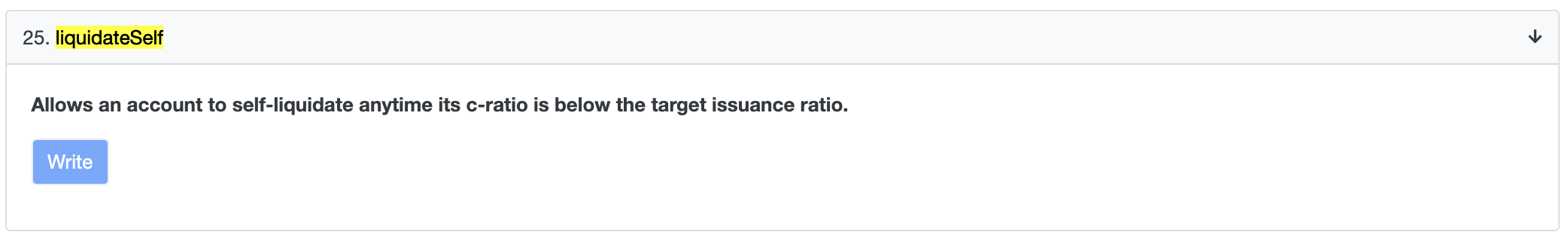

Alternatively, you can utilize the self-liquidation mechanism at any point below the target-c ratio.

People who flag SNX and liquidate accounts for liquidation will be given a reward. These rewards ensure that people run bots to automatically flag people to be liquidated and call the liquidation contract for liquidation to occur.

How do I self Liquidate?

Staking UI - https://staking.synthetix.io/staking/self-liquidate

Direct Contract Interaction

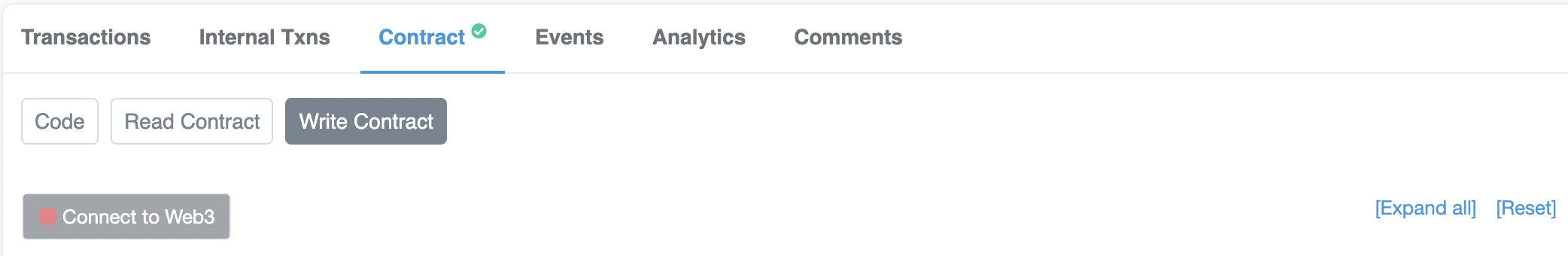

Go to Etherscan on either Mainnet or Optimism to self liquidate.

1) Mainnet - https://etherscan.io/address/0x931933807c4c808657b6016f9e539486e7B5d374#writeContract

Click write contract, then "Connect to Web3"

Click "Write" and confirm the TX. You're done!

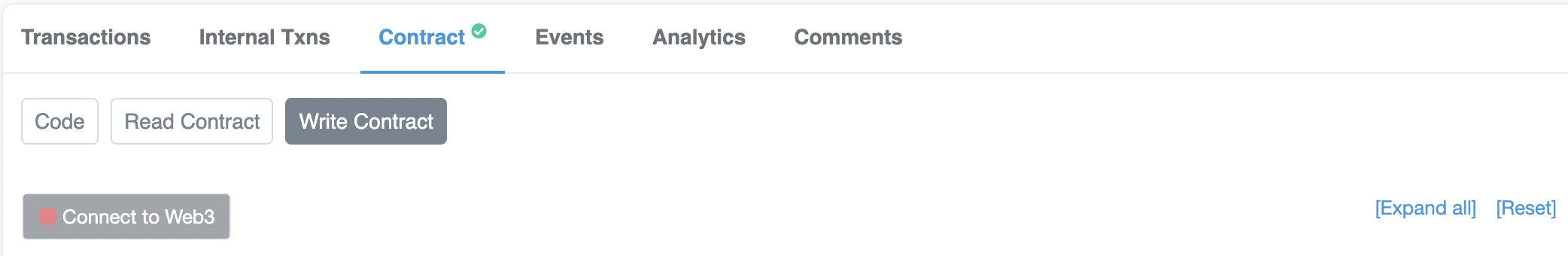

2) Optimistic Ethereum - https://optimistic.etherscan.io/address/0xc66a263f2C7C1Af0bD70c6cA4Bff5936F3D6Ef9F#writeContract

Click write contract, then "Connect to Web3"

Click "Write" and confirm the TX. You're done!

Where does the liquidated SNX go?

Liquidated SNX will incur one of two penalties. This SNX will be distributed to stakers after a 12-month escrow period.

- Self Liquidation - Governance set (see above) penalty of Staked SNX

- Regular Liquidation - Governance set (see above) penalty of Staked SNX

A new contract will be deployed that will receive liquidated SNX. This SNX will be assigned to stakers based on their percentage of the total debt shares at the time of the liquidation.

In summary - Liquidated SNX is distributed to stakers based on their proportionate share of the debt pool over a 12-month escrow.

Benefits of the new Mechanism

There are a few key benefits:

- Heavily incentivize stakers to act in the system's best interests during times of stress.

- Lower uncertainty about bad debt for synth holders and make it clear that SNX holders are the ultimate backstop for the system.

- Remove forced liquidations at inopportune times and encourage insolvent stakers to explore other options, such as self-liquidating, to avoid costly penalties.

This redesigned liquidation mechanism creates better incentive alignment within the system by providing options for stakers to repair their c-ratio with a minimal penalty if they are unable or unwilling to buy synths on the market to restore their c-ratio.

It also ensures that, in extreme scenarios, liquidations happen in an orderly manner without creating a negative feedback loop on the price of SNX. It relaxes the current liquidation mechanism by relying more on self-liquidation to protect system solvency.

Fundamentally, it creates two layers of penalties that transfer ownership of the protocol from inefficient stakers to more efficient stakers. This, combined with the existing incentives to repair c-ratios, should result in a more responsive and stable network c-ratio.

Any Questions?

Read SIP-148 for further details on the Liquidation Mechanism.

Also, read SCCP-199, which changed some of the parameters of the Liquidation Mechanism.

If you've got any comments or questions about the release, please join the conversation in Discord.