How to short using Synthetix

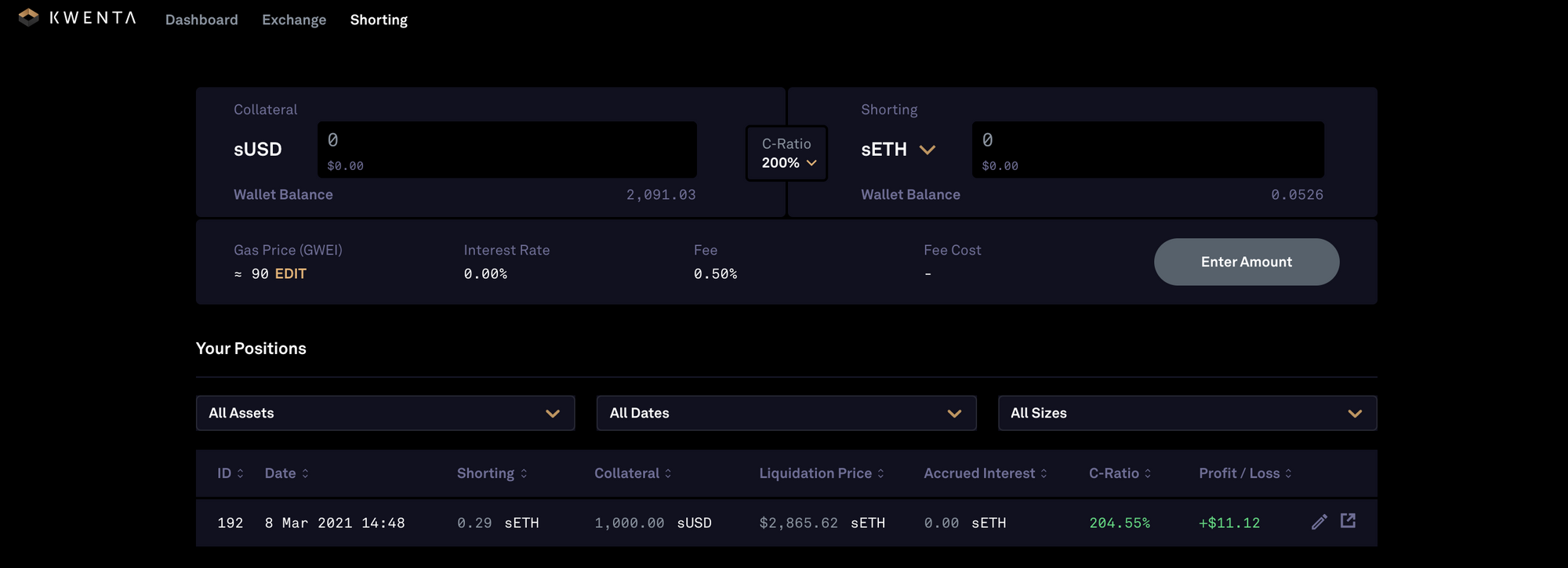

As of the end of 2020, there is a new shorting mechanism live on Synthetix! This was previously only available at a contract level, as explained here, but now Kwenta allows anyone to take out a simple short. This post will outline how the shorting dynamic works, and how to use the new interface.

How it works

The mechanism is explained comprehensively in SIP-103, but we’ll provide a summary here. It currently allows users to short sBTC and sETH against sUSD, and in this example Alice is shorting 1 sETH, which we’ll assume is worth $1000.

Alice deposits 3000 sUSD and borrows 1 sETH from the system. The borrowed sETH is automatically sold into 1000 sUSD, which is issued to her wallet. Alice has just short sold 1 sETH. To recover her collateral, she must purchase and return the 1 sETH. Let’s have a look at how an sETH price change will affect her profit.

After creating the short, Alice has 1000 sUSD in her wallet and owes the system 1 sETH. If sETH drops to $900, when she repurchases it she will have 100 sUSD profit left over. However, if sETH were to increase in value to $1100, then she would lose 100 sUSD.

If the sETH price continues to increase, she is at risk of liquidation. When Alice created her short, she locked 3000 sUSD to short 1 sETH. This put her c ratio at 300%. The liquidation mechanism is currently at 120%, so if the price of sETH rose to $2500, she would be eligible for liquidation.

Important Information

Before you open a short:

- Please note that this interface will only allow users to take out a short position at a ratio of 150% or higher, to ensure that there is a buffer to protect users from being liquidated due to relatively small price shifts.

- There is an interest rate (described in SIP-103) that is charged when the Synth exposure across the Synthetix protocol is skewed long, but there is currently a large long skew on both sETH and sBTC so it is unlikely this will occur any time soon.

- This is a more optimal form of shorting than inverse Synths for several reasons. Since you receive the sUSD proceeds of the sale, you can deploy these funds throughout DEFI to earn yield. Not many projects accept iSynths, but sUSD is integrated widely across the ecosystem. Secondly, there are no upper and lower bounds, so you don’t need to worry about your position being frozen as you do with iSynths and you do not need to factor in the implicit leverage caused by the iSynth pricing mechanism.

- While opening a short does use a high amount of gas (a limit of ~1m), please note that it costs a similar amount to use other, less efficient methods of opening a short on other popular DeFi protocols.

- There is a 50bps fee for opening a short. This is sent to the Synthetix feePool and distributed to SNX stakers.

Shorting rewards

As per SIP-108, the synthetixDAO is incentivising people to open shorts against sBTC and sETH. The sDAO will pay 8000 SNX per week to sBTC shorts and 8000 SNX per week to sETH shorts (16,000 SNX total per week). Tokens will be distributed on a pro rata basis. The motivation for this is that the debt pool is still heavily skewed toward sBTC and sETH, and in the context of a bull market this skew represents a significant risk to SNX stakers. For the latest information regarding incentives, please check Discord or the incentives page.

For more details

Come to the Synthetix Discord if you have any questions about how the new shorting mechanism works.