A Mintroduction

Edit (November 11, 2019): this information is no longer up-to-date. Here is the latest Mintroduction.

What is Mintr?

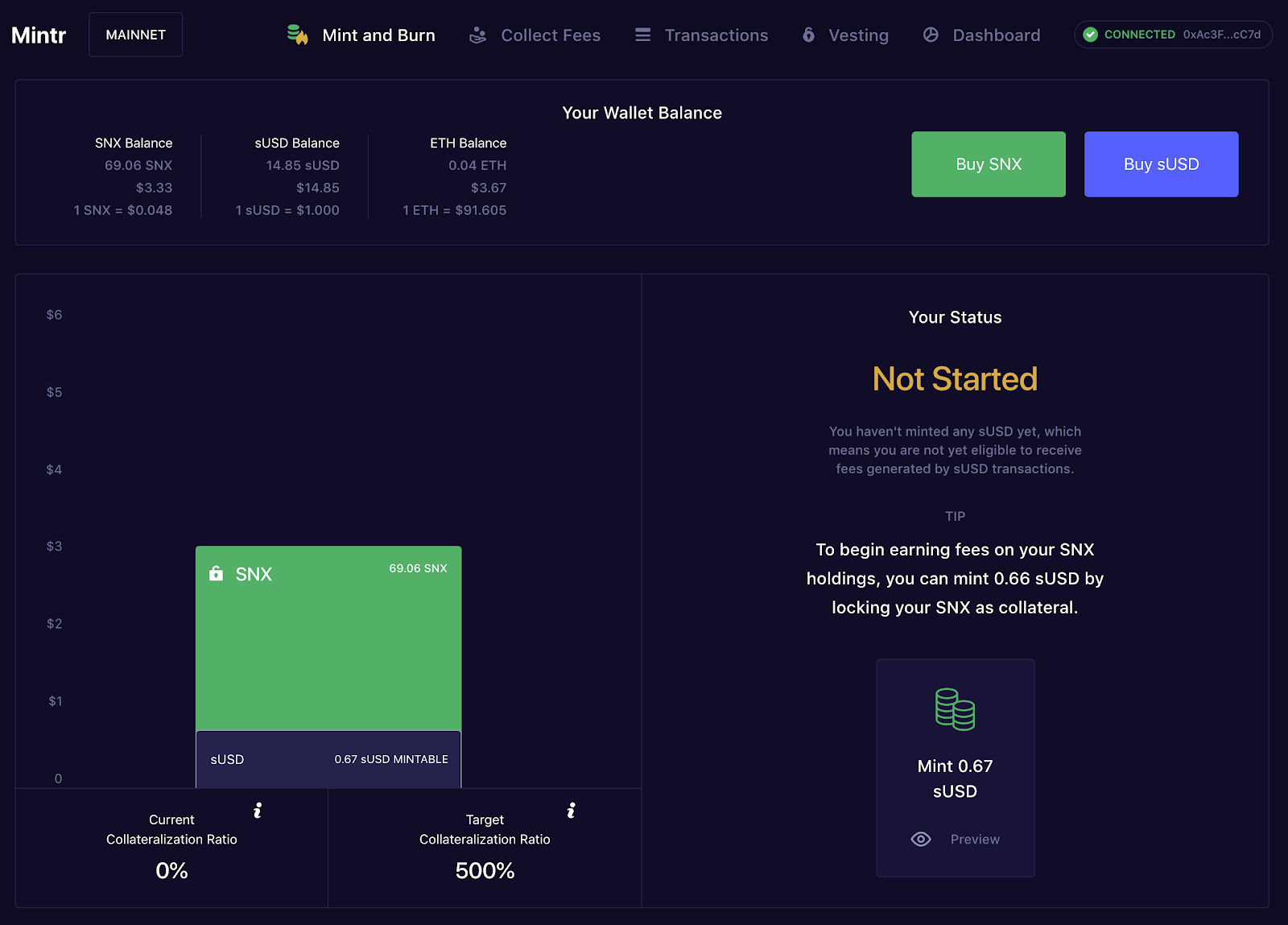

Mintr is a dApp for SNX (Synthetix Network Token) holders to mint synthetic assets (or Synths, such as sUSD) against their SNX and participate in the Synthetix Network.

Mintr provides a clean and intuitive interface that visually represents the number and value of a minter’s SNX holdings, as well as the relationship between their SNX and the Synths they’ve minted.

What can I do on Mintr?

Mintr is the home for all SNX holders’ actions. It allows them to mint and burn Synths against their SNX, collect fees generated by Synth transactions, vest any SNX still escrowed from the token sale, and view their full history of actions they’ve carried out in Mintr. We will also continue to enable further actions, such as participation in governance decisions.

How do I use it?

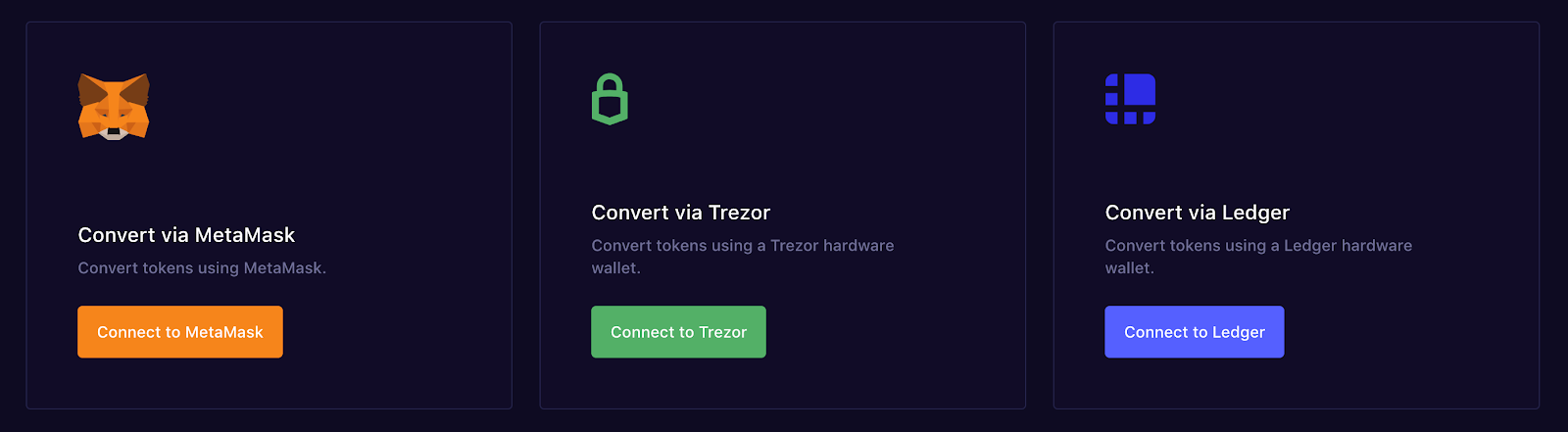

You can connect to Mintr using MetaMask or one of two kinds of hardware wallets: Trezor and Ledger. To use Mintr with any of these kinds of wallets, you must sign a transaction giving permission for Mintr to interact with your wallet, which you will be asked to do when connecting your wallet.

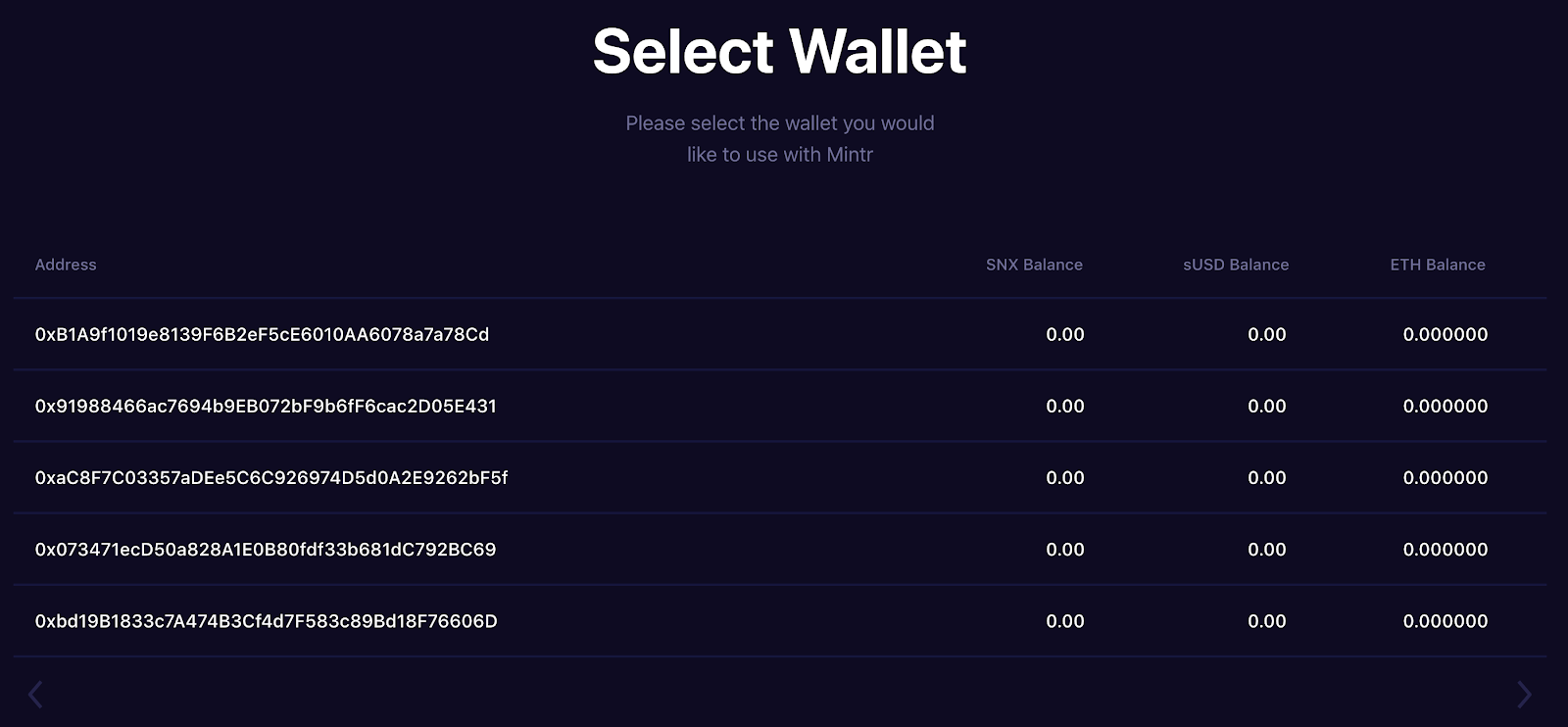

For hardware wallets that store several wallet addresses, you can choose between the addresses when you connect. Alternatively, once you have chosen a wallet address you can swap to another one from the top-right drop-down in the menu.

Minting Synths

Synthetix allows synthetic assets (Synths) to be minted against the value of SNX tokens. This is done by locking SNX into a smart contract as collateral at a ratio of 500% to the Synths minted. For example, this means that if 1000 SNX is locked at a value of $0.10 USD, 20 sUSD can be minted against it. 500% has been chosen to provide ample protection against price fluctuations.

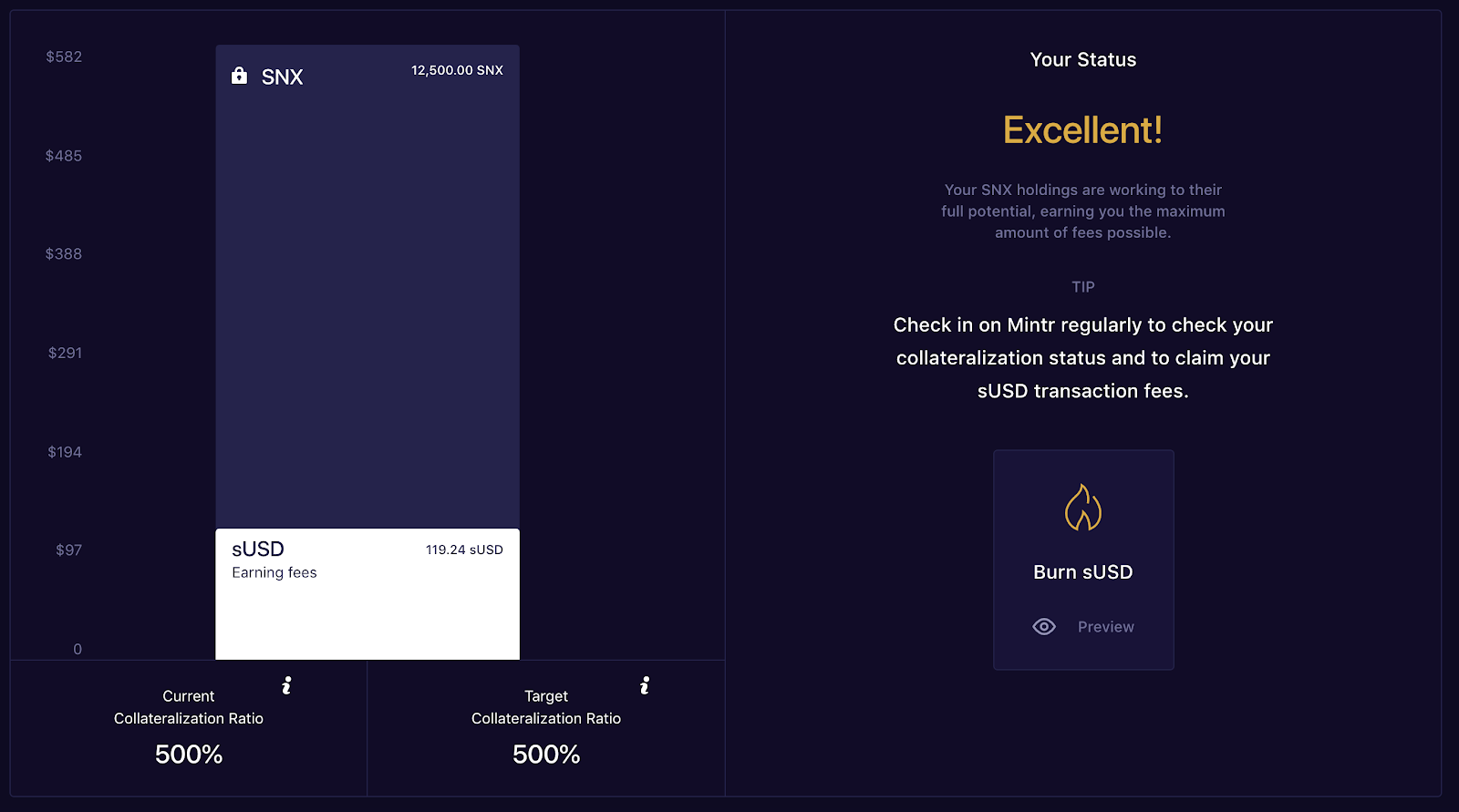

Given that the value of a minter’s locked SNX can fluctuate while it’s locked, this means that even if Synths were initially minted at a Collateralisation Ratio of 500%, your ratio can increase or decrease. Using the previous example, if the value of SNX increases from $0.10 USD to $0.12, then your Collateralisation Ratio will be 600%, and you can mint another 4 sUSD. However, if the value of SNX decreases from $0.10 to $0.08, then your Collateralisation Ratio will be 400%, and you’ll need to burn 4 sUSD to bring your Collateralisation Ratio back to 500%.

Your Collateralisation Ratio affects the proportion you receive of fees generated by Synth transactions. If your Ratio drops below 500%, you receive fewer fees, which you can read more about here. This is to incentivise SNX holders from maintaining the entire Network Collateralisation Ratio (i.e. value of total locked SNX against value of total Synths) as well as keeping Synth prices stable.

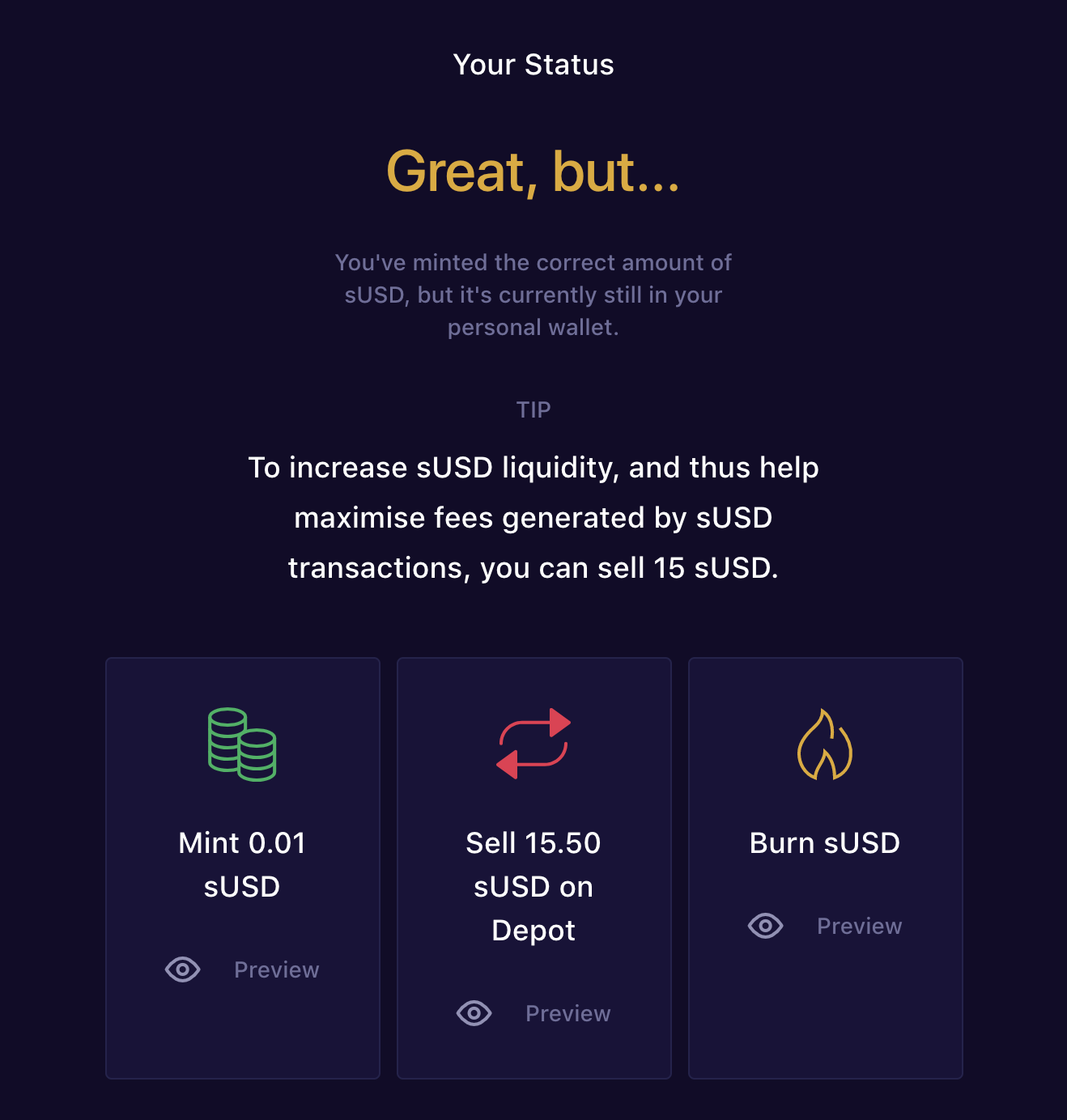

Selling Synths in the Depot

Synths are minted straight into the wallet that holds your locked SNX. But to actually contribute to the Synthetix Network, you need to increase sUSD liquidity by selling your sUSD on the market. You can do this either by selling them on an exchange, or by sending them to the Depot.

The Depot is a selling queue for Swappr, which is a user-friendly tool for conversions between ETH, sUSD, and SNX. Sending your sUSD to be sold in the Depot will place them in this selling queue, and once your sUSD has been sold, you will receive the ETH proceeds of the sale. We are planning to add a feature to Mintr to ensure you have further transparency around the status of your sUSD in the Depot queue.

Conclusion

Thank you to everyone who has already provided feedback to Mintr, either during the beta testing or since we launched it last week. Please let us know if you have any further feedback in Discord, but please keep it limited to the Tech Support, Bug Reports, or Mintr channels.

Happy minting!